Hang Seng Index Futures: Struggling to Defend the Immediate Support

rhboskres

Publish date: Mon, 30 Aug 2021, 04:37 PM

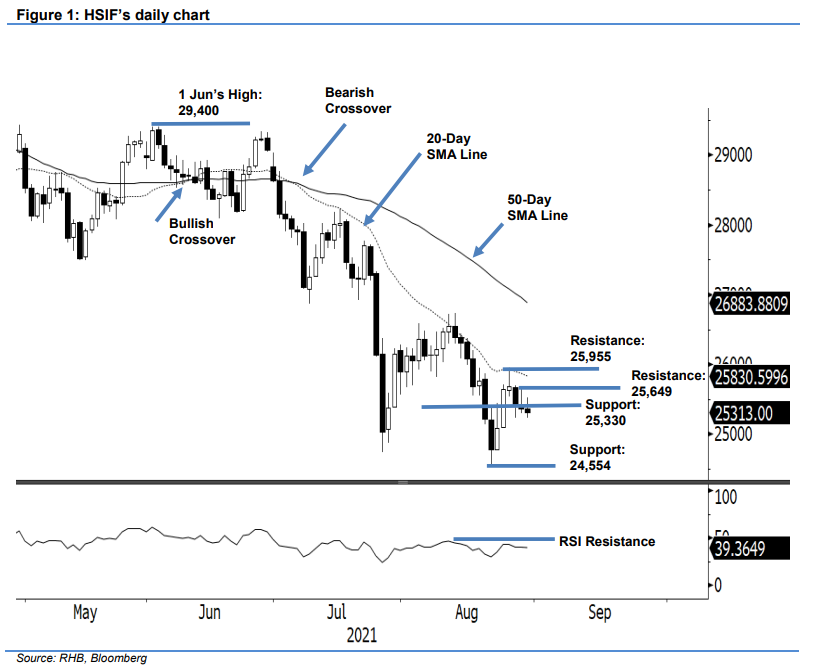

Maintain long positions. The HSIF failed to stage a technical rebound last Friday, retreating 51 pts to settle the day session at 25,366 pts as it drifted away from the 20-day SMA line. Brief momentum was witnessed during the early session. After the index opened at 25,337 pts, it jumped to test 25,649 pts before giving up the intraday gains to reach the 25,295-pt day low and closed with an Inverted Hammer. It gained 59 pts in the evening session and last traded at 25,425 pts. At the time of writing, the HSIF is trading at 25,313 pts. As of Friday’s session, the index managed to retain its position above the immediate support and maintain the “higher low” bullish pattern. Meanwhile, we expect volatility to pick up during Monday’s session, as the August futures contracts are expiring. As long as the HSIF stays above the stop-loss threshold, we stick to our positive trading bias.

Traders are advised to maintain the long positions initiated at the closing level of 24 Aug’s day session, ie 25,638 pts. To mitigate the downside risks, the stop-loss mark is revised higher to 25,229 pts.

The immediate support is kept at 25,330 pts – 29 Jul’s low – and followed by 24,554 pts, ie 20 Aug’s low. Meanwhile, the nearest resistance is sighted at 25,649 pts – 27 Aug’s high – and followed by 25,955 pts, or 25 Aug’s high.

Source: RHB Securities Research - 30 Aug 2021