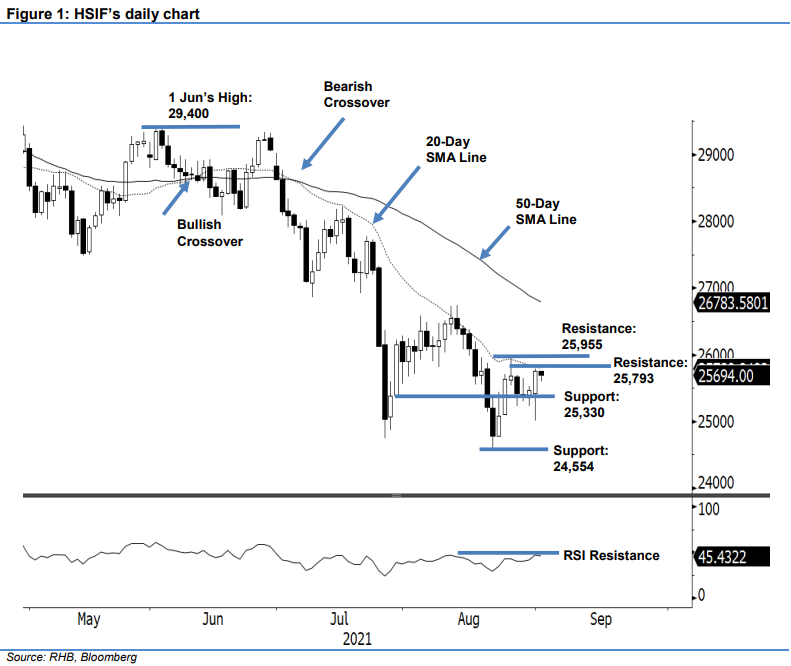

Hang Seng Index Futures: Eyeing to Cross the 20-Day SMA Line

rhboskres

Publish date: Wed, 01 Sep 2021, 04:53 PM

Maintain long positions. On the last trading session in August, the HSIF September futures contracts rose to settle at 25,754 pts. It initially opened at 25,390 pts and and experienced selling pressure during the early session, retreating to test the 25,005-pt day low. Strong bullish momentum emerged in the afternoon, lifting the index to touch 25,793 pts before the close. Mild profit-taking during the evening session saw the HSIF dip 60 pts – it last traded at 25,694 pts. The latest session reaffirmed the 25,330-pt level acting as strong support. Breaching this level again may see the recent bullish movement come to an end. Meanwhile, as the momentum picks up pace again, the index may attempt to cross above the overhead resistance of the 20-day SMA line. If this happens, the bulls will have an edge. As the stop-loss level stayed intact, we maintain our positive trading bias.

Traders should hold on to long positions initiated at the closing level of 24 Aug’s day session, ie 25,638 pts. To mitigate downside risks, the stop-loss threshold is placed at 25,229 pts.

The immediate support remains at 25,330 pts – 29 Jul’s low – and is followed by 24,554 pts, ie 20 Aug’s low. The nearest resistance sighted at 25,793 pts – 31 Aug’s high – is followed by 25,955 pts, ie the high of 25 Aug.

Source: RHB Securities Research - 1 Sept 2021