FKLI - Shifting To Bearish Momentum

rhboskres

Publish date: Thu, 02 Sep 2021, 04:27 PM

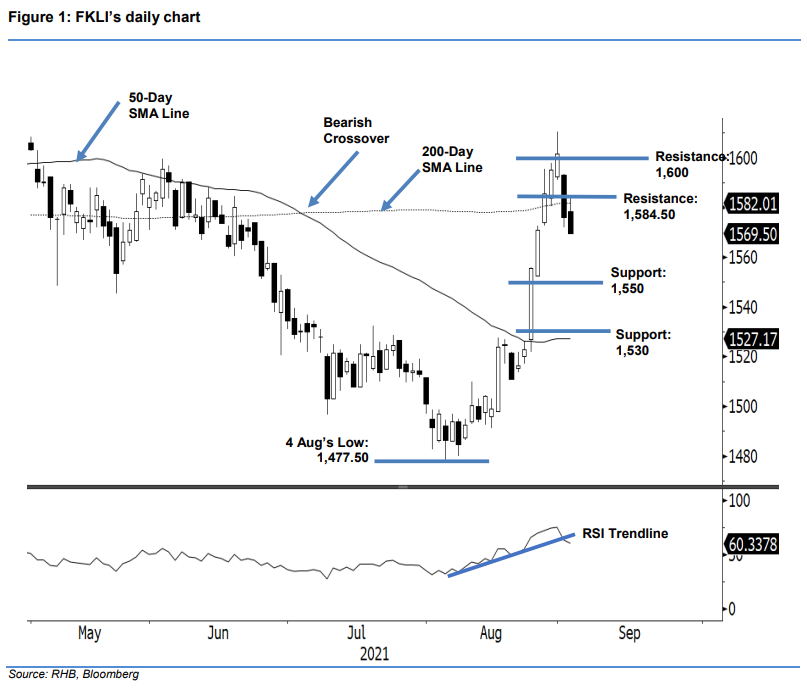

Traling-stop triggered; initiate short positions. The FKLI saw selling pressure extend yesterday, declining 6.50 pts to settle at 1,569.50 pts – breaching the previous support of 1,572.50 pts. The index initially opened stronger at 1,578.50 and rose to test the 1,584.50-pt day high. Not long after, it decelerated towards the 1,569.50-pt day low before the close – forming a back-to-back bearish candlestick. The latest session signals that the bears have resumed control – it is likely to see a follow through correction to test the 1,550-pt support. However, in the event the index reverses above the 1,600-pt level, this would likely point towards an upward trajectory. At this juncture, since the traling-stop has been breached, we shift over to a negative trading bias.

We closed out the long positions, which were initiated at 1,524 pts or the close of 17 Aug after triggering the trailing stop at 1,572.50 pts. Conversely, we initiate short positions at the close of 2 Sep, ie 1,569.50 pts. To manage the trading risks, the initial stop-loss is placed at 1,600 pts.

The immediate support is marked at 1,550 pts, followed by 1,530 pts where both are whole numbers. Meanwhile, the immediate resistance is pegged at 1,584.50 pts – the high of 2 Sep, then 1,600 pts ie the psychological level.

Source: RHB Securities Research - 2 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024