Hang Seng Index Futures: Mild Profit-Taking Above 26,000 Pts

rhboskres

Publish date: Fri, 03 Sep 2021, 04:24 PM

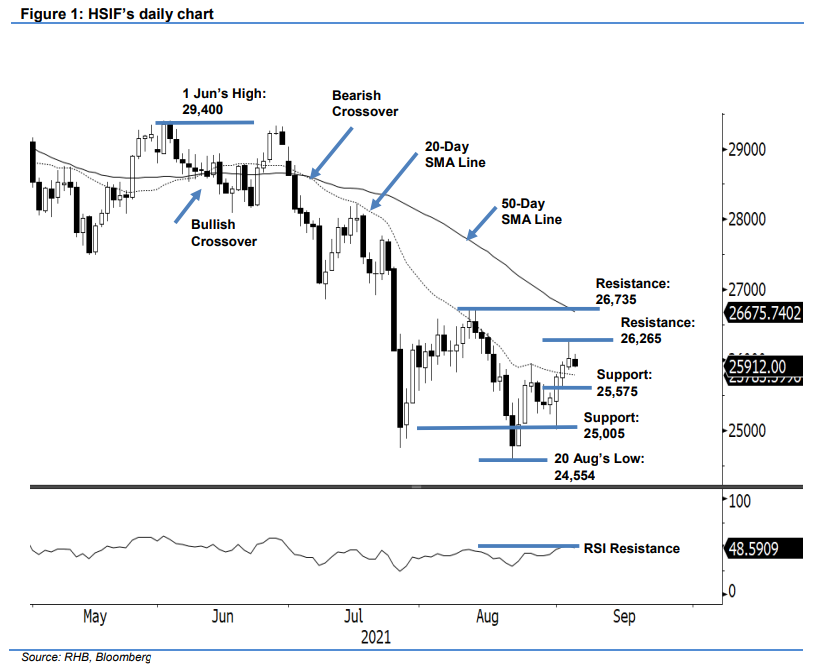

Maintain long positions. Despite mild profit-taking above 26,000 pts, the HSIF extended its ascent for the fourth consecutive session, adding 97 pts to settle the day session at 26,023 pts. After the index started off at 26,042 pts, it jumped to test the intraday high at 26,265 pts. The bears then emerged above 26,000 pts, dragging it to the 25,893- pt day low before closing at 26,023 pts. Further profit taking was seen during the evening session, where the HSIF dropped 111 pts and last traded at 25,912 pts. The candlestick with long upper shadow showed that the bears were dominant between 26,000 and 26,265 pts. The index may retrace to consolidate near the 20-day SMA line before staging a fresh attempt to cross the immediate resistance. As long as the HSIF stays above the 20-day SMA line, sentiment will remain optimistic. As of now, we maintain our positive trading bias.

We advise traders to keep to the long positions initiated at the closing level of 24 Aug’s day session, ie 25,638 pts. For trading-risk management, the stop-loss threshold is fixed at 25,366 pts.

The immediate support is marked at 25,575 pts – 1 Sep’s low – and followed by 25,005 pts, ie 31 Aug’s low. The nearest resistance is revised to 26,265 pts – 2 Sep’s high – and followed by 26,735 pts, ie 12 Aug’s high.

Source: RHB Securities Research - 3 Sept 2021