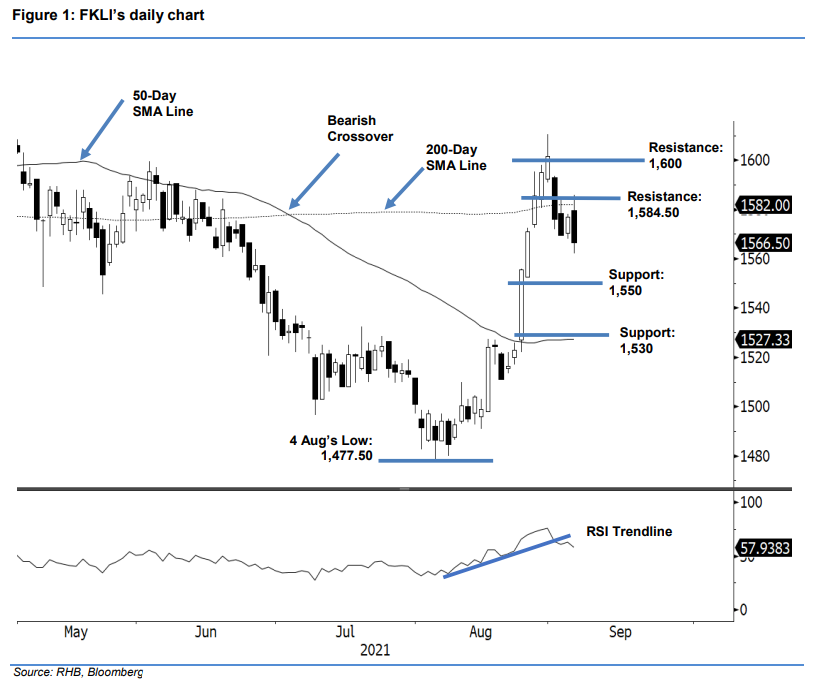

FKLI: Selling Pressure Persists At The 200-Day SMA Line

rhboskres

Publish date: Tue, 07 Sep 2021, 10:26 AM

Maintain short positions. The FKLI was blocked by the 200-day SMA line again, retracing 10.50 pts to settle weaker at 1,566.50 pts. The index initially opened stronger at 1,579.50 pts to test the 1,586-pt day high. However, the resistance at the 200-day SMA line proved too resilient, resulting in selling pressure dragging the index towards 1,562 pts before the close. The bearish session reaffimed the 1,584.50-pt level as a strong immediate resistance. We do not rule out another attempt in the near future to retest the overhead resistance, however the risk is tilted towards the downside as the RSI is falling off the uptrend line. As momentum is decelerating, the index needs to find an interim low by forming a candlestick with long lower shadow or a bullish reversal pattern. Without any of these, it may continue to drift lower towards the next support level anticipated at 1,550 pts. At this stage, we keep to our negative trading bias.

Traders are advised to maintain short positions initiated at 1,569.50 pts or the close of 2 Sep. To control the trading risks, the stop-loss is placed at 1,587 pts.

The immediate support is marked at 1,550 pts, followed by the lower support at 1,530 pts. Conversely, the first resistance remains at 1,584.50 pts – the high of 2 Sep, followed by the 1,600-pt psychological level.

Source: RHB Securities Research - 7 Sept 2021