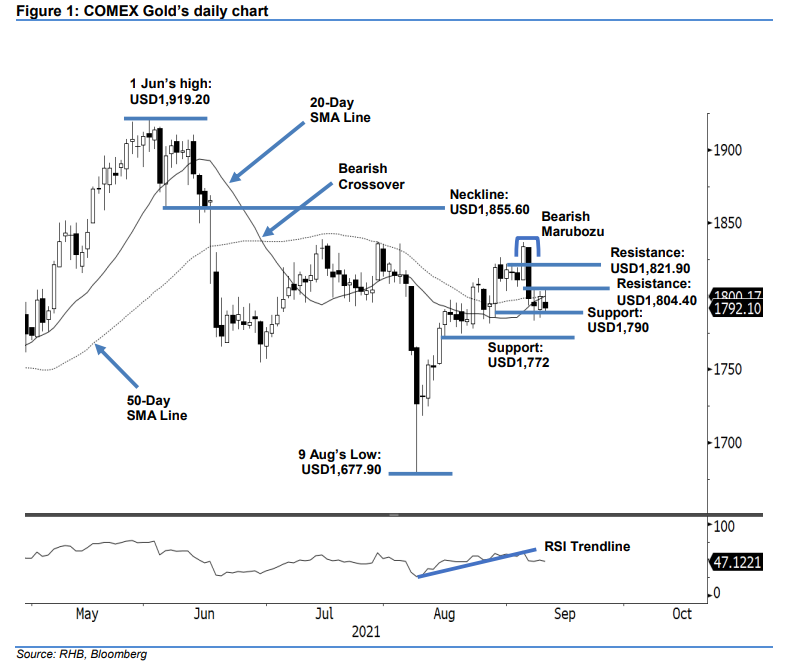

COMEX Gold: Falling Below the 20-Day SMA Line

rhboskres

Publish date: Mon, 13 Sep 2021, 08:52 AM

Maintain long positions. The COMEX Gold slipped below the 20-day SMA line last Friday, declining USD7.90 to settle at USD1,792.10. It started at MYR1,796.2, and rose to test the day’s high of USD1,806. However, positive momentum failed to follow through, and the index turned south to touch USD1,788.20 before closing at USD1,792.10. The Bearish Marubozu candlestick remains intact, and selling pressure near the 20-day SMA line persists. The commodity may consolidate sideways before attempting to cross above the moving average again. Despite the commodity drifting below the 20-day SMA line – showing early signs of a bearish structure – we keep our positive trading bias until the trailing-stop is breached.

We recommend traders retain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To mitigate downside risks, the trailing-stop is set at USD1,790.

The immediate support remains at USD1,790, followed by USD1,772 – 16 Aug’s low. The nearest resistance is set at USD1,804.40 – 8 Sep’s high – followed by USD1,821.90, or 31 Aug’s high.

Source: RHB Securities Research - 13 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024