WTI Crude: Inching Higher Above the 50-Day SMA Line

rhboskres

Publish date: Tue, 14 Sep 2021, 08:41 AM

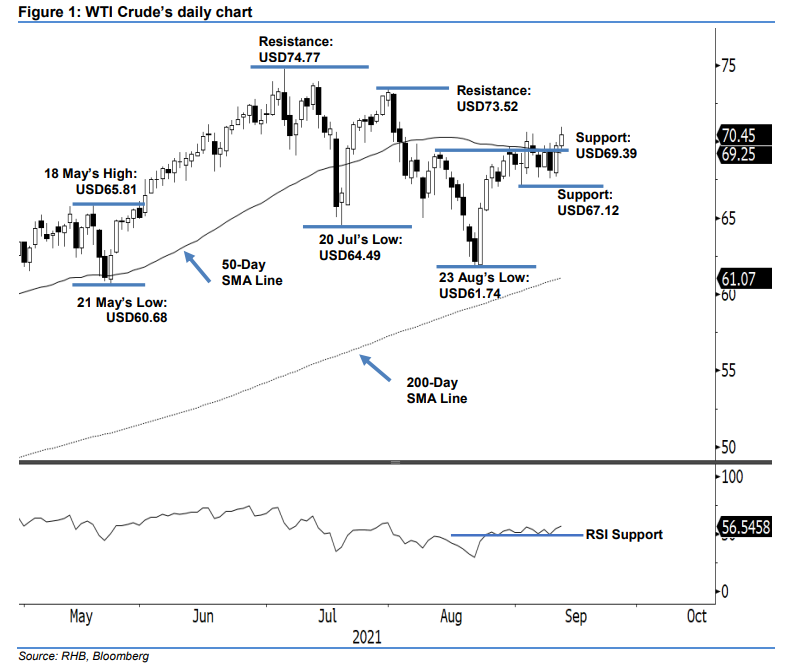

Maintain long positions. The WTI Crude continued its positive momentum above the 50-day SMA line yesterday, which saw it rising USD0.73 to close at USD70.45 – moving further away from the immediate support. It began at USD69.74 and hit the day low at USD69.51 before strong buying interest emerged. It then moved northwards towards its close – touching the day’s high at USD70.97 before a minor pullback prior to the close. The white body candlestick above both the immediate support and average line signifies the follow-through of recent buying momentum, and increases the odds of propelling the commodity towards the nearest resistance at USD73.52. Supported by the RSI pointing higher above the 55% level, we expect the bullish momentum to continue in the coming sessions. Unless the momentum reverses, we retain our bullish trading bias.

Traders should keep to the long positions initiated at USD67.54, ie the closing level of 24 Aug. To mitigate risks, the stop-loss level is set at USD67.12, or 1 Sep’s low.

The support levels are pegged at USD69.39 – 12 Aug’s high – and USD67.12, ie 1 Sep’s low. The immediate resistance levels are set at USD73.52 – 30 Jul’s high – and USD74.77, which was 6 Jul’s high.

Source: RHB Securities Research - 14 Sept 2021