E-Mini Dow: Bouncing Off Near the Immediate Support

rhboskres

Publish date: Tue, 14 Sep 2021, 08:42 AM

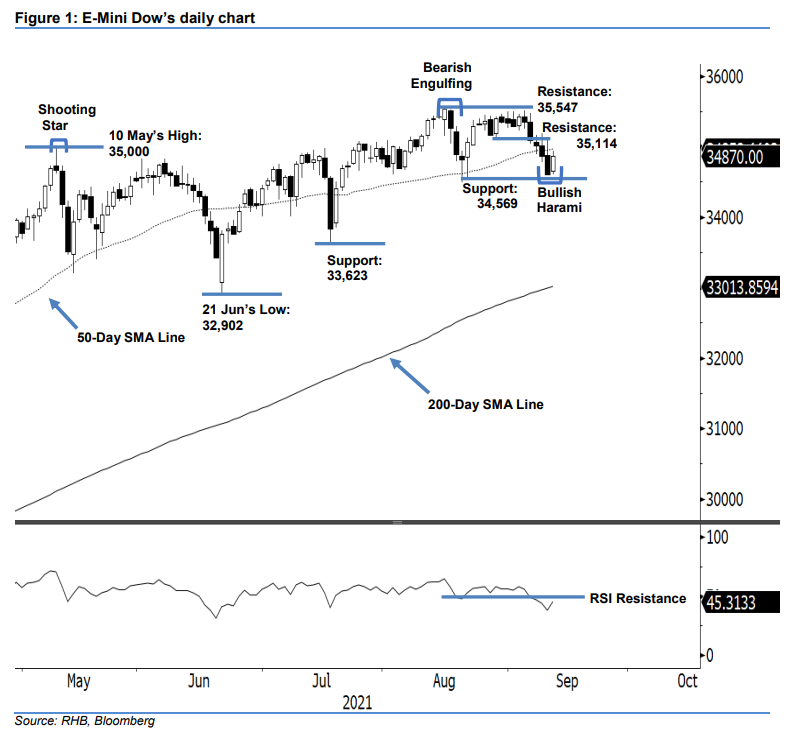

Keep short positions. The E-Mini Dow shifted its momentum after bouncing off above the immediate support yesterday, which saw the index closing 263 pts higher at 34,870 pts – setting off the previous session’s losses. The E-Mini Dow opened at 34,647 pts and whipsawed between at 34,601 pts and 34,935 pts in an uptrend fashion towards the close – a sharp pullback occured during the US trading session before it bounced off strongly towards the close. The long white body candlestick with “bullish harami” candlestick pattern signals an uptrend reversal in the coming sessions – eyed towards the immediate resistance. However, the medium term outlook remains bearish, as the E-Mini Dow has yet to breach both the average line and immediate resistance level. Moreover, despite the RSI inching higher yesterday, the strength remains below the 50% level. Hence, we maintain our bearish trading bias until the stop-loss level is breached.

We recommend traders stay in the short positions initiated at the closing level of 7 Sep, ie 35,091 pts. To manage the risks, the stop-loss threshold is set at 35,114 pts, ie the immediate resistance.

The nearest support is fixed at 34,569 pts – 20 Aug’s low – and then followed by 33,623 pts, or 19 Jul’s low. The resistance points are pegged at 35,114 pts – 27 Aug’s low – and 35,547 pts, ie 16 Aug’s high.

Source: RHB Securities Research - 14 Sept 2021