FCPO: Attempting To Stage a Rebound

rhboskres

Publish date: Tue, 14 Sep 2021, 08:03 AM

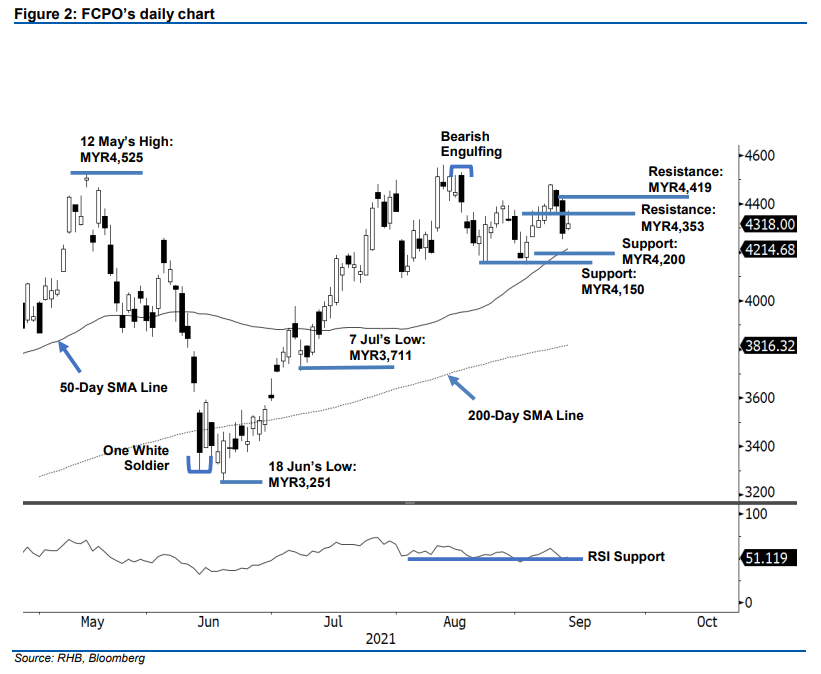

Maintain short positions. The FCPO saw the negative momentum failed to follow-through, rebounding MYR40 to settle at MYR4,318. After the strong selling last Friday, the commodity started off Monday’s session stronger at MYR4,299. Once it established the day’s low at MYR4,290, the commodity rebounded upwards to test the intraday high at MYR4,370. Mild profit taking in the afternoon session brought the commodity lower to close at MYR4,318. The latest session reaffirms that the MYR4,353-pt level is acting as a strong resistance. Although the commodity did not record another fresh “lower low”, causing only a mild rebound to occur, the positive price action did not erase the bearish candlestick formed last Friday. Hence, the bearish sentiment still lingers and downside risk remains. In the event the negative momentum picks up pace again, the commodity may retrace lower to test the 50-day SMA line (MYR4,214). Premised on this, we hold on to our negative trading bias.

We recommend traders keep their short positions initiated at MYR4.278, or the closing level of 10 Sep. For trading risks management, the initial stop-loss is placed at MYR4,419, or the high of 10 Sep.

The nearest support is marked at the MYR4,200 round figure, followed by the MYR4,150, the low of 2 Sep. The immediate resistance is pegged at MYR4,353 – the low of 8 Sep – followed by MYR4,419, or the high of 10 Sep.

Source: RHB Securities Research - 14 Sept 2021

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)