Hang Seng Index Futures : Negative Momentum Is Accelerating

rhboskres

Publish date: Fri, 17 Sep 2021, 04:08 PM

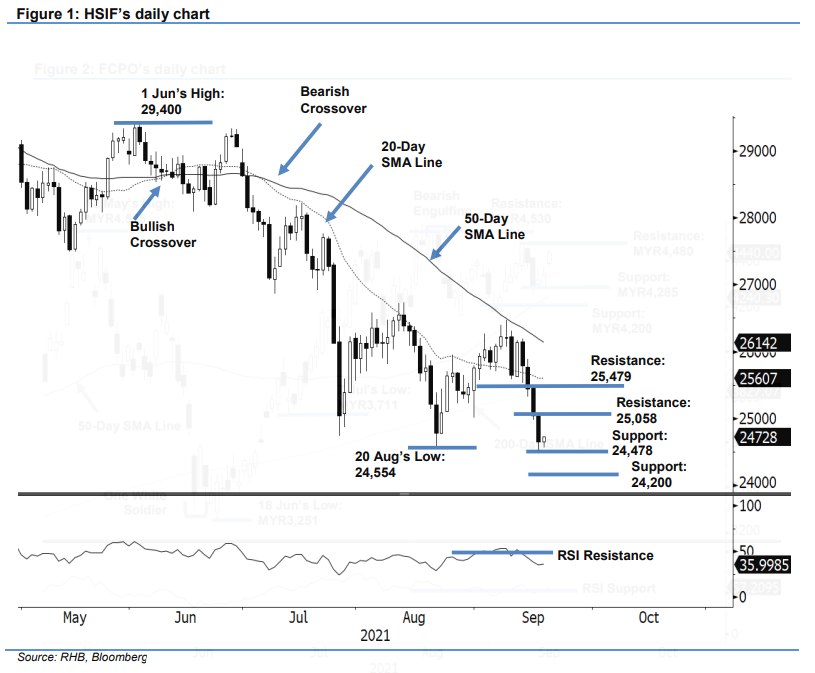

Maintain short positions. The HSIF failed to hold at the 25,000-pt psychological level, falling 391 pts to settle Thursday’s session at 24,647 pts. It opened weaker at 24,990 pts. Risk-off sentiment brought it lower to the 24,478-pt day low before mildly rebounding to close at 24,647 pts. During the evening session, the index recouped 81 pts and was last traded at 24,728 pts. With the RSI falling below the 50% threshold, negative momentum is accelerating. With the bears in control, the index has been printing a series of “lower highs with lower lows” bearish patterns. In a typical downtrend, the resistance tends to be strong, while support is weak. As such, we believe downside risks remain, and the index may continue to drift lower. For now, we make no change to our negative trading bias.

Traders should hold on to the short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To manage trading risks, the stop-loss is revised to 25,400 pts.

The nearest support is revised to 24,478 pts – 16 Sep’s low – followed by the lower support at 24,200 pts. The immediate resistance is revised to 25,058 pts, or the high of 16 Sep, followed by 25,479 pts (the high of 15 Sep).

Source: RHB Securities Research - 17 Sept 2021