E-Mini Dow : Struggling Near the Immediate Support Level

rhboskres

Publish date: Fri, 17 Sep 2021, 04:14 PM

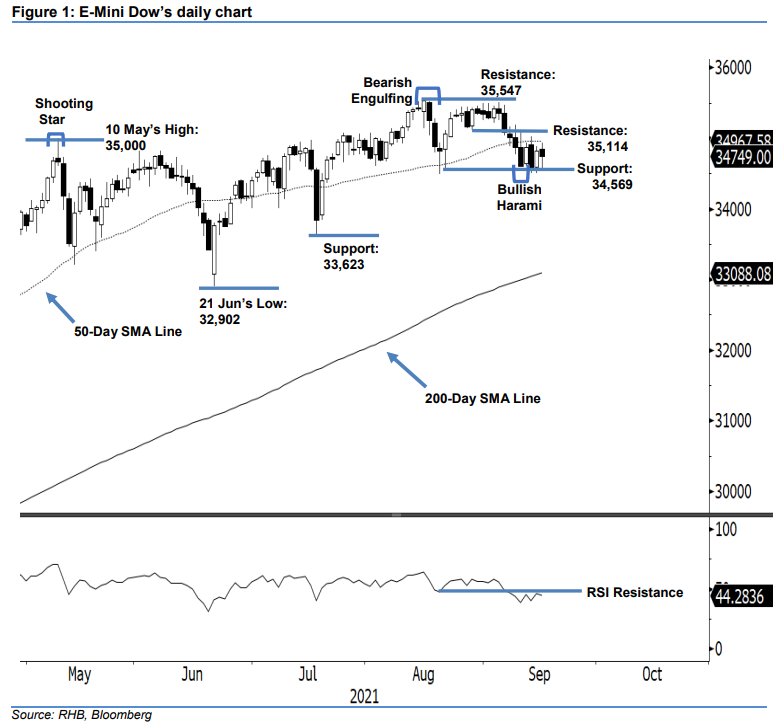

Maintain short positions. The E-Mini Dow’s attempt to touch the 50-day SMA line failed yesterday, with the index falling 70 pts to settle at 34,749 pts – still hovering between the average line and immediate support level. It began at 34,850 pts and oscillated sideways, until a sudden spike in buying momentum emerged in the early part of the US trading session. It touched the 35,942-pt day high, but the momentum was short lived. Momentum then shifted to negative, with the index falling towards the day’s low of 34,537 pts, before bouncing off strongly towards the close at 34,749 pts. The black body candlestick with a long lower shadow signals a neutral tone between the average line and immediate support level for the coming sessions. However, the bearish medium-term outlook remains, as the E-Mini Dow is still trading below the average line and immediate resistance. The RSI was also weaker, below the 45% level yesterday. Hence, we stick to our bearish trading bias.

We recommend traders keep to the short positions initiated at the closing level of 7 Sep, or 35,091 pts. To manage risks, the stop-loss threshold is set at 35,114 pts – the nearest resistance.

The support thresholds remain at 34,569 pts – 20 Aug’s low – and 33,623 pts, which was 19 Jul’s low. The resistance levels are unchanged at 35,114 pts, or 27 Aug’s low, and 35,547 pts, which was 16 Aug’s high.

Source: RHB Securities Research - 17 Sept 2021

.png)