Hang Seng Index Futures: Plunging to a Multi-Month Low

rhboskres

Publish date: Tue, 21 Sep 2021, 09:11 AM

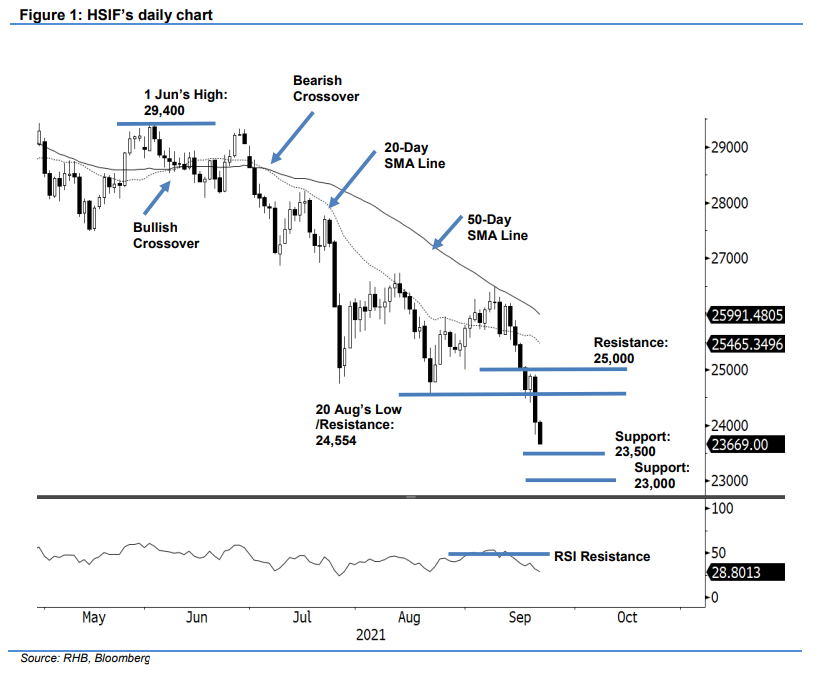

Maintain short positions. The HSIF saw negative momentum accelerate yesterday, amid risk-off sentiment, plunging 820 pts to settle the day session at 24,062 pts. On the first trading session of the week, it opened flat at 24,661 pts. However, the index did not find its interim bottom, plunging to the 23,831-pt day low before the close. Further correction was seen during the evening session, with the index falling 393 pts. It was last traded at 23,669 pts. At this juncture, the index is retreating to levels last seen in Oct 2020. With the strong selling pressure in play, it may drift lower to test the 23,500-pt immediate support. A breach of this level would see another bearish leg towards the oversold region, or the 23,000-pt psychological level. As the index is still displaying a “lower highs with lower lows” bearish structure, we keep our negative trading bias.

Traders are recommended to keep the short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. For risk management, the trailing-stop is placed at 24,800 pts.

The nearest support is seen at 23,500 pts, followed by the lower support level at the 23,000-pt round figure. The immediate resistance is set at 24,554 pts, or the low of 20 Aug, followed by the 25,000-pt psychological level.

Source: RHB Securities Research - 21 Sept 2021