COMEX Gold: Looking to Cross the Immediate Resistance

rhboskres

Publish date: Thu, 23 Sep 2021, 05:09 PM

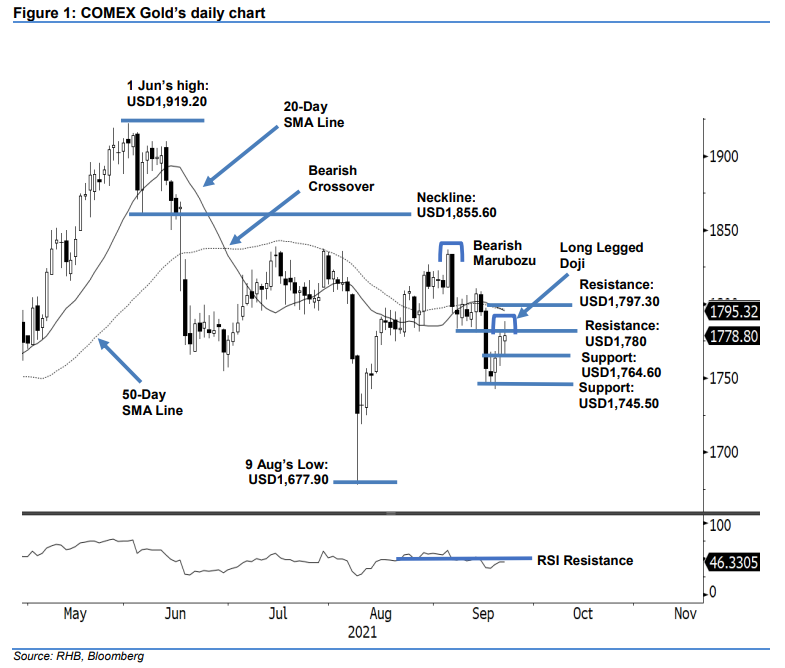

Maintain short positions. The COMEX Gold saw positive momentum extend yesterday, rising marginally by USD0.06 to settle at USD1,778.80. The commodity started at USD1,775 and moved sideways for most of the session. Volatility picked up during the US session, with the index jumping to test the session’s USD1,788.40 high before falling to the session’s low of USD1,764.60. It then settled at USD1,778.80 and printed a Long Legged Doji. The session showed that the bulls and bears share equal strength, and the index is poised for sideways movement. If commodity falls below USD1,764.60, or the nearest support level, selling pressure may accelerate again. The RSI is trending neutral below the 50% threshold, suggesting that momentum is neutral. Unless the commodity is able to stage an upside breakout, we stick to our negative trading bias.

Traders should hold on to the short positions initiated at USD1,756.70 or the closing level of 16 Sep. To manage trading risks, the stop-loss is set at USD1,780.

The first support is revised to USD1,764.60, the low of 22 Sep, followed by USD1,745.50 or 16 Sep’s low. The immediate resistance remains at USD1,780, followed by USD1,797.30 or 16 Sep’s high.

Source: RHB Securities Research - 23 Sept 2021