FKLI: Crossing Above The 50-Day SMA Line

rhboskres

Publish date: Fri, 24 Sep 2021, 04:41 PM

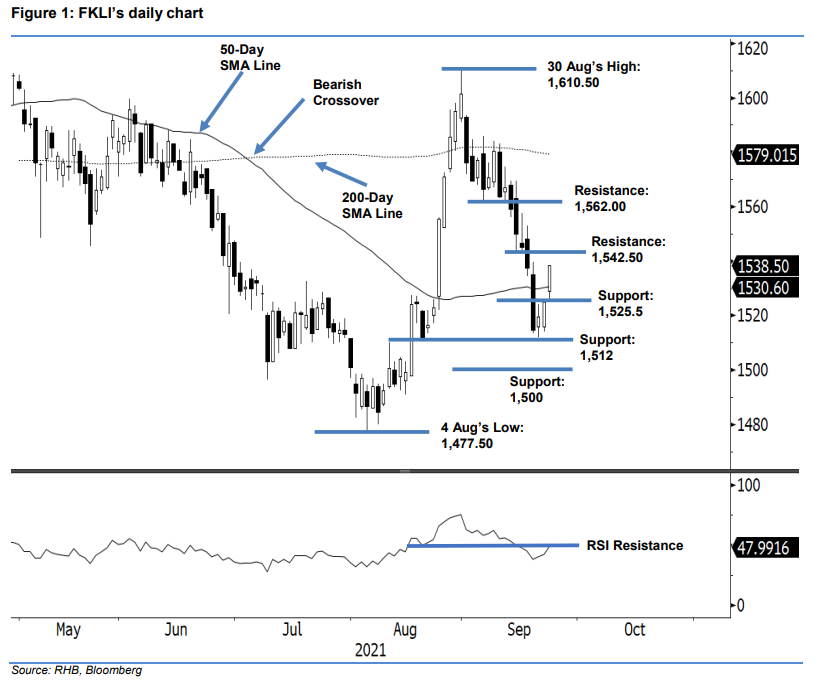

Trailing-stop triggered; initiate long positions. The FKLI continued its positive rebound yesterday, with the index rising 13.5 pts to settle at 1,538.5 pts. It gapped up to open at 1,529 pts, and retreated to the day’s low of 1,525.5 pts. Strong bullish momentum then emerged to send the index towards the day’s peak of 1,526 pts, which was also the close. The latest “White Marubozu” bullish candlestick, crossing above the average line, indicates that bullish momentum is getting stronger, to test the 1,542.5-pt level. The recent sharp increase of RSI strength, from below 40% to near 50% yesterday, indicates a significant reversal of strength, which may follow through in the coming sessions. As the FKLI has breached above the trailing-stop, we shift to a positive trading bias.

We closed out the short positions initiated at 1,569.50 pts, or the close of 2 Sep, after the trailing-stop at 1,535 pts was triggered. Conversely, we initiate long positions at the closing level of 23 Sep, or 1,538.50 pts. To manage trading risks, the initial stop-loss threshold is placed at 1,512 pts.

The immediate support is adjusted to 1,525.5 pts, or the low of 23 Sep, followed by 1,512 pts or 21 Sep’s low. The nearest resistance is pegged at 1,542.50 pts – the low of 15 Sep – followed by 1,562 pts or 10 Sep’s low.

Source: RHB Securities Research - 24 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024