COMEX Gold : Attempting to Rebound From September’s Low

rhboskres

Publish date: Mon, 27 Sep 2021, 08:56 AM

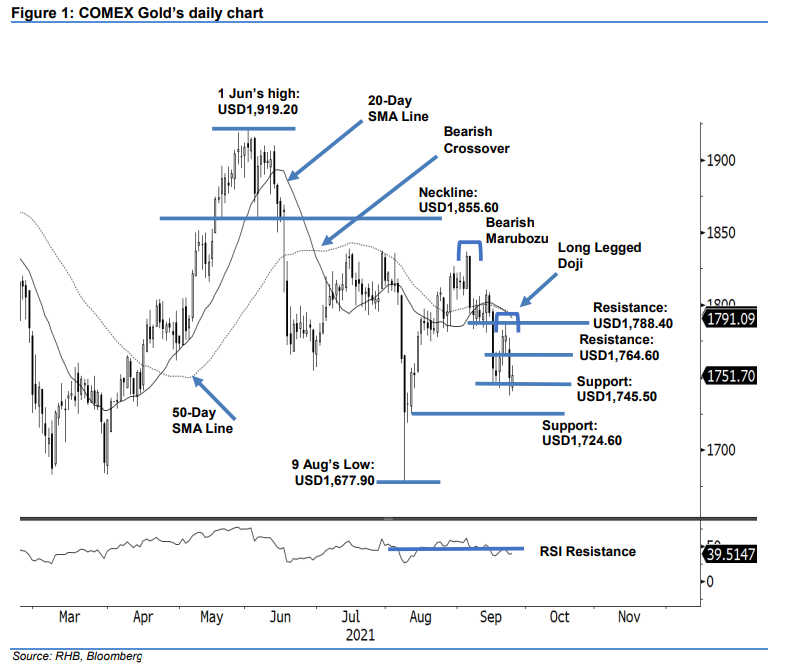

Maintain short positions. The COMEX Gold bounced mildly off the immediate support last Friday, rising USD1.90 to settle at USD1,751.70. The commodity started the session at USD1,743.70 – the selling pressure tapered at the USD1,740.20 session low, which saw the commodity inch higher to touch the USD1,758 session high before the close. At the latest session, the closing price is higher than its opening, indicating the bulls are attempting to retain the USD1,745.50 immediate support to avert a fresh “lower low”. If it manages to form a bullish pattern, there might be a chance of seeing a technical rebound in the coming sessions. Otherwise, breaching the immediate support will attract strong selling pressure again. At this stage, we continue to hold on to our negative trading bias.

We recommend traders maintain the short positions initiated at USD1,756.70, ie the closing level of 16 Sep. To mitigate the trading risks, the stop-loss threshold is fixed at USD1,780.

The first support remains at USD1,745.50 – 16 Sep’s low – and followed by the USD1,724.60 low of 11 Aug. Meanwhile, the immediate resistance is pegged at USD1,764.60 – 22 Sep’s low – and followed by USD1,788.40, ie the high of 22 Sep.

Source: RHB Securities Research - 27 Sept 2021