E-Mini Dow : Strong Bulls Take a Pause

rhboskres

Publish date: Mon, 27 Sep 2021, 08:58 AM

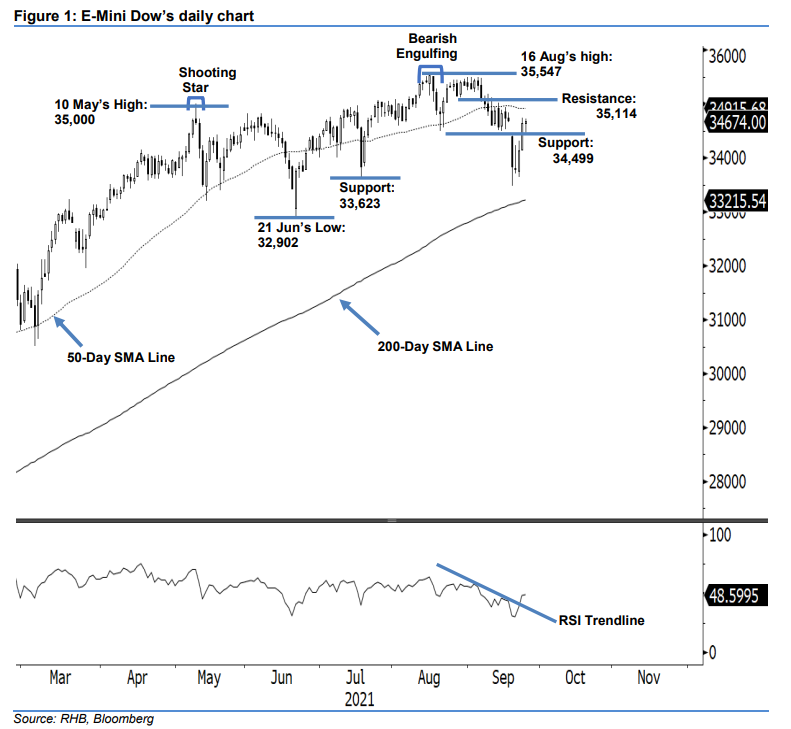

Maintain long positions. Following the recent strong bullish momentum, the E-Mini Dow slowed down its positive momentum last Friday by adding a mere 30 pts to settle at 34,674 pts – paring its intraday losses to close positive. The index opened in a positive tone at 33,650 pts, oscillating between the 34,459-pt low and 34,734-pt high in a mildly positive direction. The white body candlestick with long lower shadow printed yesterday, which was above the immediate support, indicates that strong buying pressure emerged above the immediate support to sustain the uptrend momentum. Hence, a follow-through of the bullish momentum is likely to be seen in the coming sessions. Supported by the RSI’s increasing strength lately towards the 50% level, this signals that the buying strength is gaining traction and expected to persist in the coming sessions. As such, we stay with our positive trading bias, which we shifted to in our previous note.

We suggest traders keep to the long positions initiated at the closing level of 23 Sep, ie 34,644 pts. To manage risks, the initial stop-loss threshold is pegged at the 33,623-pt support.

The immediate support level is unchanged at 34,499 pts – 15 Sep’s low – and followed by 33,623 pts, which was 19 Jul’s low. The resistance levels are fixed at 35,114 pts – 27 Aug’s low – and 35,547 pts, or 16 Aug’s high.

Source: RHB Securities Research - 27 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024