WTI Crude : the Bullish Momentum Strengthens Further

rhboskres

Publish date: Mon, 27 Sep 2021, 08:59 AM

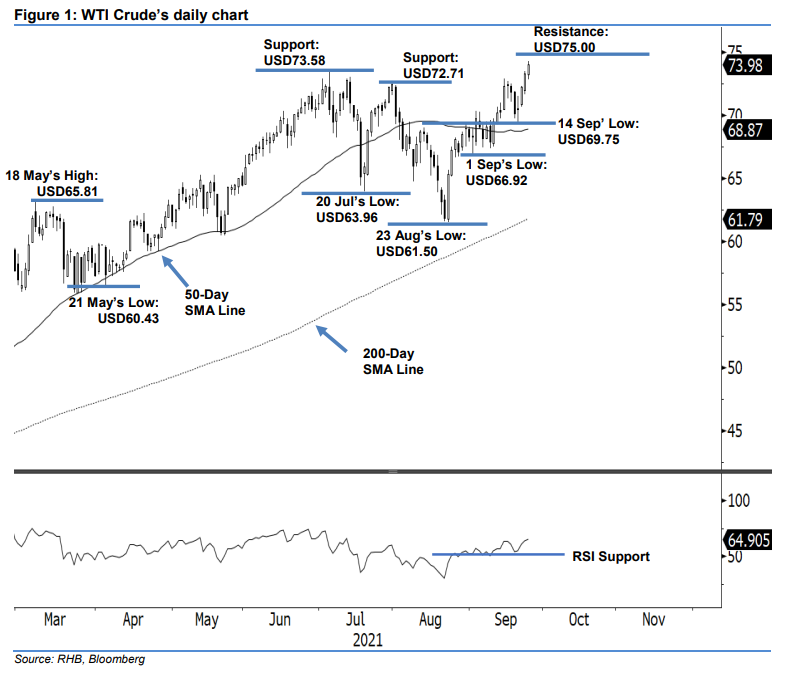

Keep long positions. The WTI Crude continued its fourth consecutive session of positive momentum last Friday, jumping USD0.68 to settle at USD73.98 – breaking away from its immediate resistance. It opened lower at USD73.24 and then whipsawed in a sideways direction to touch the day’s bottom at USD72.81 early during the US trading session. Strong buying momentum kicked in immediately to propel the commodity upwards towards the end of the session – hitting the USD74.27 day peak before its close. The latest bullish candlestick – forming a “Three White Soldiers” bullish candlestick pattern – solidifies further the uptrend movement above the recent 52-week high threshold or immediate resistance – is expected to follow through in the coming sessions. Nevertheless, we do not discount the possibility of mild profit-taking occuring in the coming sessions. Amid the RSI rising above the 60% level, the positive strength is expected to persist in the medium term. Hence, we stick to our bullish trading bias.

Traders should stay in the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage risks, the initial trailing-stop threshold is pegged at USD69.75, ie 14 Sep’s low.

The support levels are revised to USD73.58 – 6 Jul’s high – and USD72.71, which was 30 Jul’s high. The immediate resistance level is set at USD75.00 and followed by the USD76.00 next resistance.

Source: RHB Securities Research - 27 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024