Hang Seng Index Futures: Consolidating Above the Immediate Support Level

rhboskres

Publish date: Tue, 28 Sep 2021, 09:02 AM

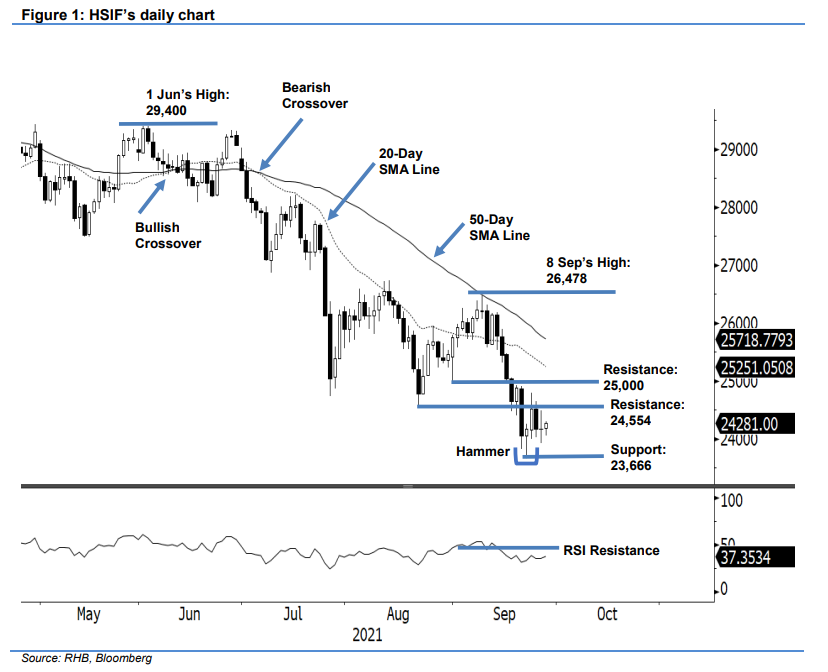

Maintain short positions. The HSIF’s selling pressure subsided during Monday’s session, closing unchanged at 24,168 pts. The index started the week at 24,053 pts and was buoyed by positive sentiment, rising sharply to test the 24,490-pt day high. After the morning session’s strong surge, the bears took profit in the afternoon, dragging the index lower to close at 24,168 pts. It bounced off 113 pts during the evening session, and was last traded at 24,281 pts. As it is almost the end of the month, volatility may pick up due to the futures contract expiring. If the HSIF breaks past the 24,554-pt immediate resistance, it may climb further to reclaim the 25,000-pt psychological level. Otherwise, it will consolidate sideways near the immediate support, pending the next breakout. For now, we are keeping our bearish trading bias until the stop-loss is breached.

Traders are recommended to stick with the short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To mitigate trading risks, the stop-loss threshold is pegged at 24,800 pts.

The immediate support remains at 23,666 pts – 21 Sep’s low – followed by the 23,400-pt round figure. The nearest resistance stays at 24,554 pts – 20 Aug’s low – and the higher resistance is at the 25,000-pt psychological level.

Source: RHB Securities Research - 28 Sept 2021