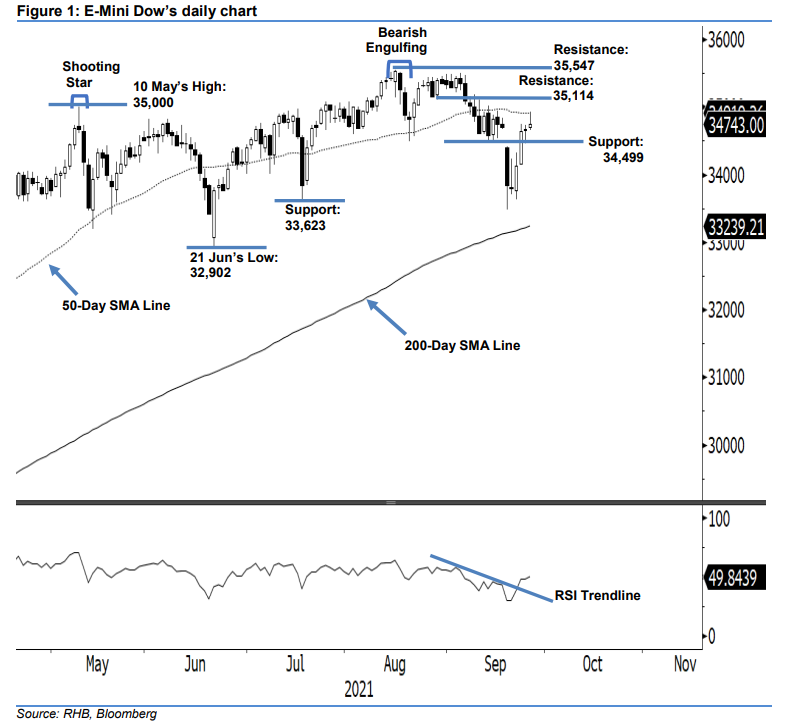

E-Mini Dow: Attempting to Move Above the 50-Day SMA Line

rhboskres

Publish date: Tue, 28 Sep 2021, 09:02 AM

Maintain long positions. Despite attempting to jump higher, the E-Mini Dow retreated from its intraday gains yesterday to close mildly positive by 69 pts at 34,743 pts – touching the 50-day average line. The index started positively at 34,696 pts and then whipsawed – it hit the day’s bottom at 34,652 pts ahead of the US trading sesson. Strong buying interest then re-emerged to propel the E-Mini Dow towards the 34,934-pt day’s peak, albeit shortlived. Selling pressure then appeared to drag the index lower towards the close. The white body candlestick with long upper shadow printed yesterday hit the average line, indicating the bulls are still eager to move higher but were blocked by selling pressure near the average line. Hence, a follow through of the bullish momentum is likely if the E-Mini Dow manages to surpass the 50-day SMA line level of 34,919 pts. With the RSI strength increasing near the 50% level, this signals that buying momentum remains intact. With that, we stick with our bullish trading bias.

We suggest traders stick to the long positions initiated at the closing level of 23 Sep, ie 34,644 pts. To manage risks, the initial trailing-stop threshold is introduced at the 34,499-pt support.

The nearest support level is fixed at 34,499 pts – 15 Sep’s low – and then followed by 33,623 pts, or 19 Jul’s low. The resistance levels are unchanged at 35,114 pts – 27 Aug’s low – and 35,547 pts, ie 16 Aug’s high.

Source: RHB Securities Research - 28 Sept 2021