Hang Seng Index Futures: Still Consolidating Sideways

rhboskres

Publish date: Thu, 30 Sep 2021, 09:30 PM

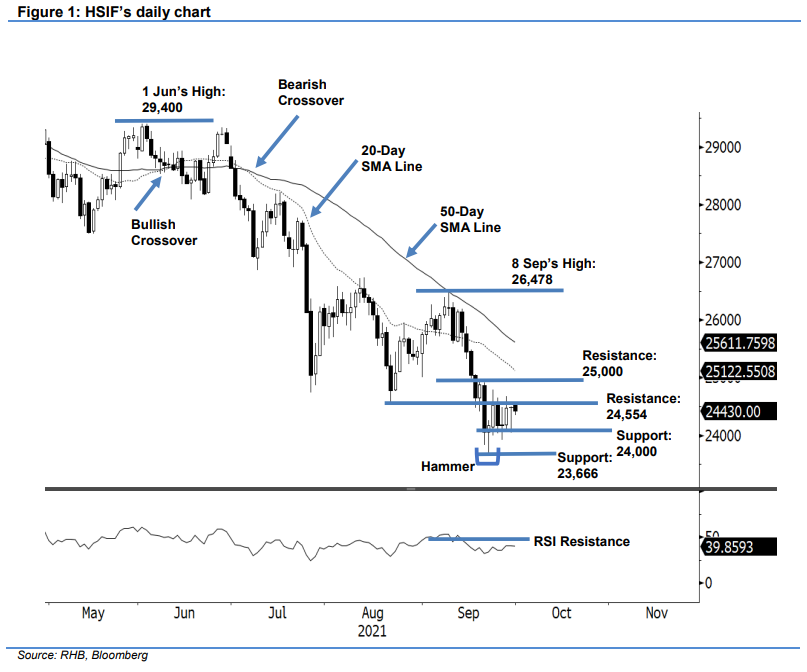

Maintain short positions. The HSIF’s September futures contracts have expired and the index settled at 24,485 pts after a volatile session on Wednesday. With regards to the October futures contracts, the HSIF started the session at 24,259 pts but fell to the 23,988-pt day low before a sharp U-turn that saw it climb higher, reaching a 24,666-pt day high before closing the day session at 24,515 pts. Mild profit-taking in the evening session saw the index retracing 85 pts – it last traded at 24,430 pts. Despite a strong intraday rebound that leaves behind a candlestick with long lower shadow, the HSIF still kept between the sideways range of 24,554 pts and 24,000 pts. Until it breaks out of either boundary, we expect the index to consolidate horizontally for the coming sessions. Meanwhile, we stick to our bearish trading bias until the stop-loss level is breached.

Traders should maintain the short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To curb the trading risks, the trailing-stop threshold is set at 24,800 pts.

The nearest support is revised to 24,000 pts and followed by 23,666 pts, ie 21 Sep’s low. Meanwhile, the first resistance stays at 24,554 pts – 20 Aug’s low – with the next hurdle eyed at the 25,000-pt psychological level.

Source: RHB Securities Research - 30 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024