COMEX Gold: Drifting Lower to Search for Support

rhboskres

Publish date: Thu, 30 Sep 2021, 09:32 PM

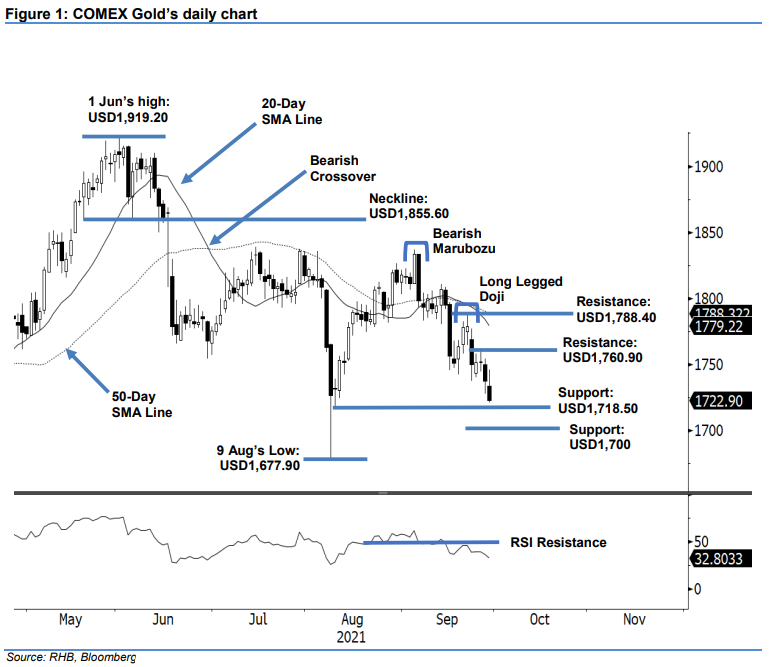

Maintain short positions. The COMEX Gold extended the downward movement yesterday, declining USD14.60 to settle at USD1,722.90. The commodity initially opened at USD1,734. At one point, it staged an intraday rebound to test the USD1,746 session high. However, sentiment turned negative again during the US trading session, where the COMEX Gold corrected to the USD1,721.10 session low and closed at USD1,722.90. This latest session showed that the bears remain in control – hence, downside risks remain. The downward movement that started since USD1,788.40 may extend further to test the USD1,718.50 level. Breaching this will see the precious metal losing its shine towards the USD1,700 psychological level. The chart shows that, on 9 Aug, a candlestick with long lower shadow formed – the COMEX Gold may stage a technical rebound between the USD1,718.50 and USD1,700 range. Albeit expecting a near-term rebound, we retain our negative trading bias.

Traders are recommended to keep the short positions initiated at USD1,756.70, or the closing level of 16 Sep. For trading-risk management, the stop-loss mark is adjusted to USD1,770.

The immediate support is revised to USD1,718.50 – 10 Aug’s low – and followed by the USD1,700 round figure. The nearest resistance remains at USD1,760.90 – 27 Sep’s high – followed by USD1,788.40, ie 22 Sep’s high.

Source: RHB Securities Research - 30 Sept 2021