Hang Seng Index Futures: Moving Back Above 25,000 Pts

rhboskres

Publish date: Fri, 01 Oct 2021, 08:33 AM

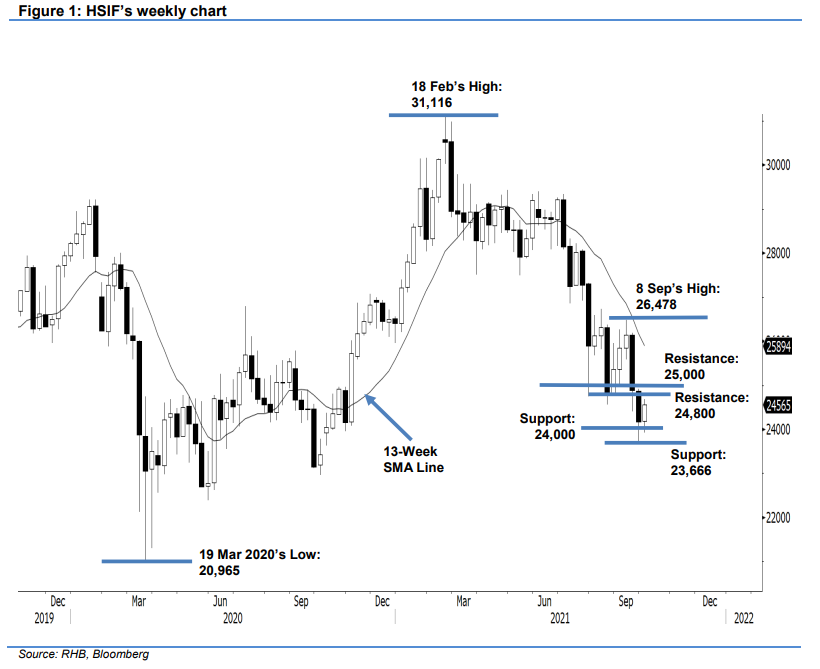

Maintain short positions. The HSIF’s weekly candlestick rebounded from its 52-week low – it last traded at 24,565 pts as it attempted to recoup the losses incurred in the previous week. We observed the 13-week SMA line turning lower, indicating the longer-term trend is still moving downwards. However, the index managed to form an interim base near 23,666 pts and is poised to test the 24,800-pt immediate resistance. If it manages to break past this threshold, we may see a technical rebound testing the next hurdle at the 25,000-pt psychological level. Since the HSIF has yet to form a fresh “higher high” on a weekly basis, we expect strong selling pressure to emerge near the 24,800-pt to 25,000-pt range. We believe the downside risk remains; hence, we retain our negative trading bias.

Traders are recommended to keep their short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To mitigate the trading risks, the trailing-stop mark is fixed at 24,800 pts.

For the near term, the immediate support is marked at 24,000 pts and followed by the lower support level at 23,666 pts, ie 21 Sep’s low. Conversely, the first resistance is revised to the 24,800-pt round figure, with the higher resistance at the 25,000-pt psychological level.

Source: RHB Securities Research - 11 Oct 2021