E-Mini Dow: Bouncing Off the 200-Day Average Line

rhboskres

Publish date: Mon, 04 Oct 2021, 08:44 AM

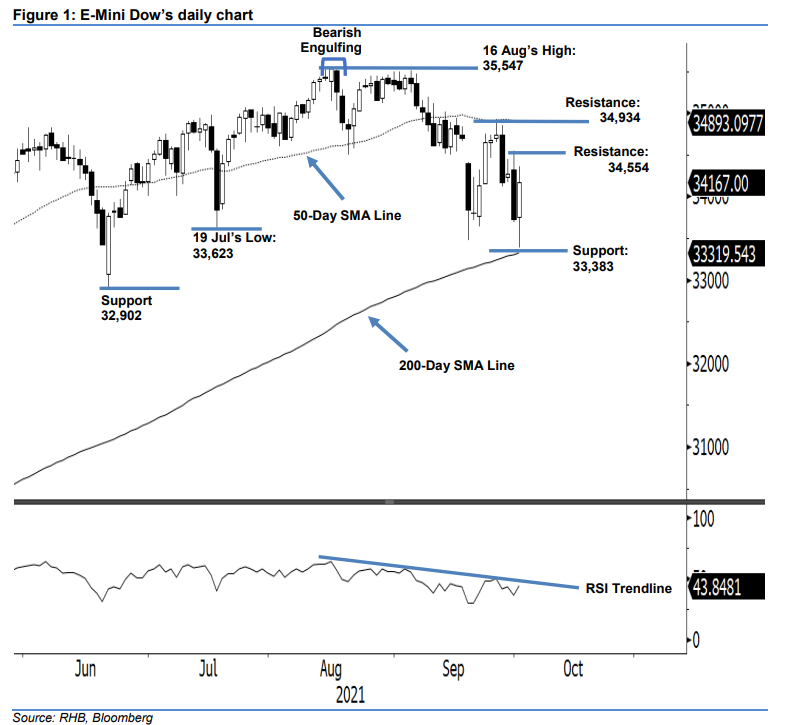

Maintain short positions. The E-Mini Dow saw a mildly positive end to the week last Friday, partially paring Thursday’s losses and jumping 445 pts to 34,167 pts – bouncing off the 200-day average line. The index opened on a positive note at 33,752 pts. It gradually moved lower to hit the day’s low of 33,383 pts before switching its direction to move upwards, after the end of the Asian trading session. It touched the day’s peak of 34,354 pts before retracing to close. The latest long white candlestick with a long lower shadow signals that bullish momentum has emerged above the 200-day average line. Nevertheless, it is still maintaining the “lower high” and “lower low” bearish structure. Despite the RSI improving yesterday, it is still showing weak strength of below 45%, which indicates continued bearish momentum ahead. As such, we keep our bearish trading bias until the stop-loss is triggered.

We suggest traders keep the short positions initiated at 34,175 pts, or the closing level of 29 Sep. To mitigate risks, the initial stop-loss is set at the 34,554-pt resistance, or the nearest resistance level.

The nearest support point is adjusted to 33,383 pts – 1 Oct’s low –followed by 32,902 pts, or 21 Jun’s low. The resistance levels are unchanged at 34,554 pts – 30 Sep’s high – and 34,934 pts, or 27 Sep’s high.

Source: RHB Securities Research - 4 Oct 2021