E-Mini Dow: Bears Still in Control

rhboskres

Publish date: Tue, 05 Oct 2021, 08:38 AM

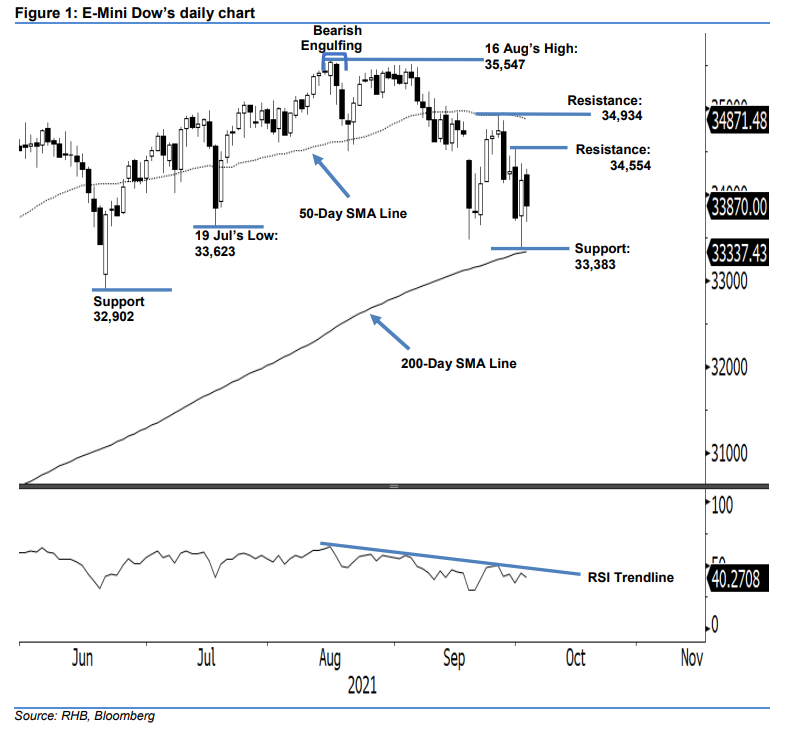

Maintain short positions. The E-Mini Dow switched back to negative momentum yesterday, after firmly dropping 297 pts to settle at 33,870 pts – heading south towards the 200-day average line. Despite the index starting on a positive note at 34,230, and attempting to move higher – touching the intraday high of 34,293 pts – selling pressure kicked in to reverse its direction for the rest of the session. Selling pressure intensified during the US trading session, which saw it hit the day’s low of 33,681 pts before bouncing off mildly to settle at 33,870 pts. The latest bearish candlestick, which pared almost all the previous session’s gains, signals that the bears are back in the driver’s seat – amid the “lower high” and “lower low” bearish structure. With the RSI weakening towards the 40% level yesterday, this solidifies the continued bearish momentum ahead. Hence, we stay with our bearish trading bias until the stop-loss – which is also the immediate resistance level – is triggered.

We suggest traders stick to the short positions initiated at 34,175 pts, or the closing level of 29 Sep. To mitigate risks, the initial stop-loss is pegged at the 34,554-pt resistance, or the immediate resistance level.

The nearest support level is fixed at 33,383 pts – 1 Oct’s low – followed by 32,902 pts, or 21 Jun’s low. The resistance levels are still at 34,554 pts – 30 Sep’s high – and 34,934 pts, which was 27 Sep’s high.

Source: RHB Securities Research - 5 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024