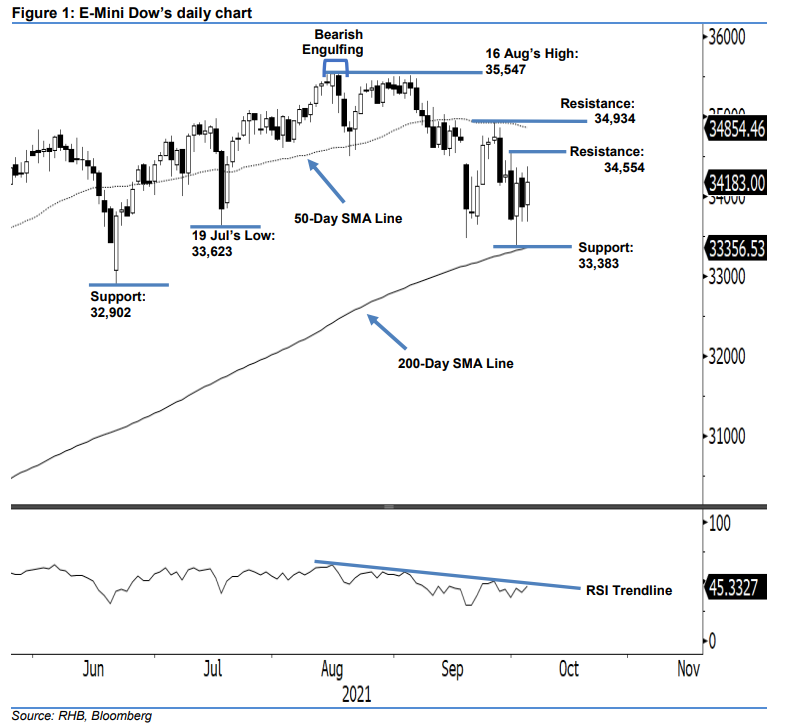

E-Mini Dow: Consolidating Sideways Below the 34,554-Pt Resistance

rhboskres

Publish date: Wed, 06 Oct 2021, 05:23 PM

Maintain short positions. After switching back to a negative momentum on Monday, the E-Mini Dow bounced off positively to recoup the losses by jumping 313 pts to settle at 34,183 pts. However, it remains below the immediate resistance of 34,554 pts. It started on a positive note at 33,890 pts but declined sharply towards the 33,684-pt intraday low before buying pressure swiftly kicked in following the start of the Asian trading session. The buying pressure then persisted throughout the session to hit the day’s peak at 34,364 pts before retreating lower to close at 34,183 pts. The latest bullish candlestick with upper and lower shadows – following the recent bearish movement – suggests the bears are just taking a break below the 50-day average line before heading lower towards the 200- day average line or immediate support. This is as the “lower high” and “lower low” bearish structures remain intact. While the RSI improved slightly yesterday, it still shows weak strength below the 50% level, which sets the continued bearish momentum ahead. Hence, we stick to our bearish trading bias until the stop loss is triggered.

We suggest traders keep to the short positions initiated at 34,175 pts, ie 29 Sep’s close. To mitigate risks, the initial stop-loss mark is set at the 34,554-pt resistance, ie the immediate resistance level.

The nearest support level remains intact at 33,383 pts – 1 Oct’s low – and followed by 32,902 pts or 21 Jun’s low. The resistance levels are unchanged at 34,554 pts – 30 Sep’s high – and 34,934 pts, ie 27 Sep’s high.

Source: RHB Securities Research - 6 Oct 2021