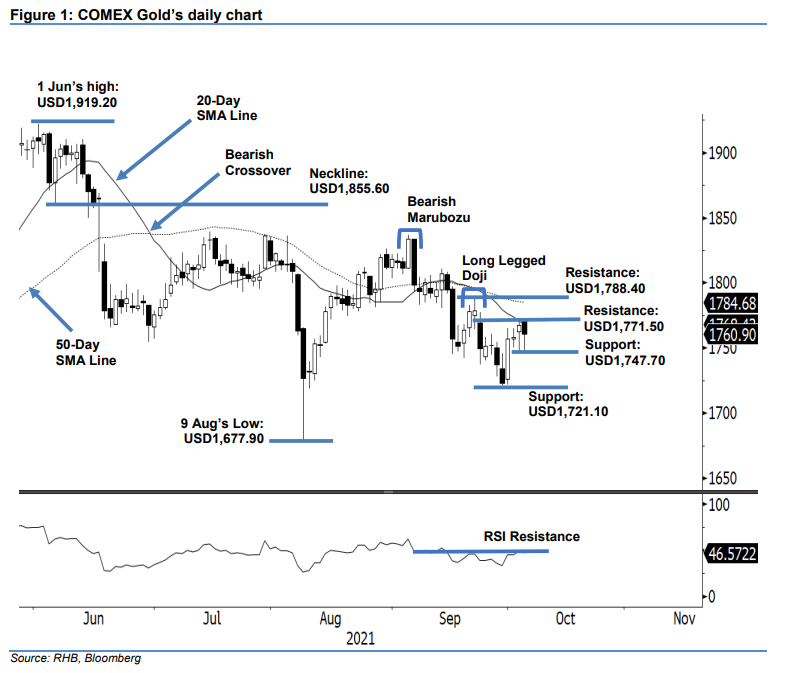

COMEX Gold: Mild Selling Pressure Near the 20-Day SMA Line

rhboskres

Publish date: Wed, 06 Oct 2021, 05:25 PM

Maintain long positions. The COMEX Gold saw selling pressure emerge near the 20-day SMA line yesterday, retracing USD6.70 to settle at USD1,760.90. The commodity began Tuesday’s session with cautious sentiment. It opened at USD1,770.80 and retreated to the USD1,748.60 session low amid profit-taking activities. Positive demand seen during the US trading session narrowed the intraday losses and the COMEX Gold closed at USD1,760.90. For the past three sessions, the commodity formed a “higher low” above the USD1,750 psychological level. Breaching the threshold and USD1,747.70 immediate support may see the yellow metal reverting to a downside correction again. If the positive momentum is able to lift the COMEX Gold beyond the 20- day SMA line, the bullish technical set-up will be strengthened. As of now, we retain our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,767.60, ie the closing level of 4 Oct. Conversely, to manage the downside risks, the stop-loss threshold is raised to USD1,743.

The immediate support is revised to USD1,747.70 – 4 Oct’s low – and followed by USD1,721.10, or 29 Sep’s low. The nearest resistance is changed to USD1,771.50 – 4 Oct’s high – and followed by USD1,788.40, ie 22 Sep’s high.

Source: RHB Securities Research - 6 Oct 2021