Hang Seng Index Futures: Attempting to Stage a Technical Rebound

rhboskres

Publish date: Wed, 06 Oct 2021, 05:25 PM

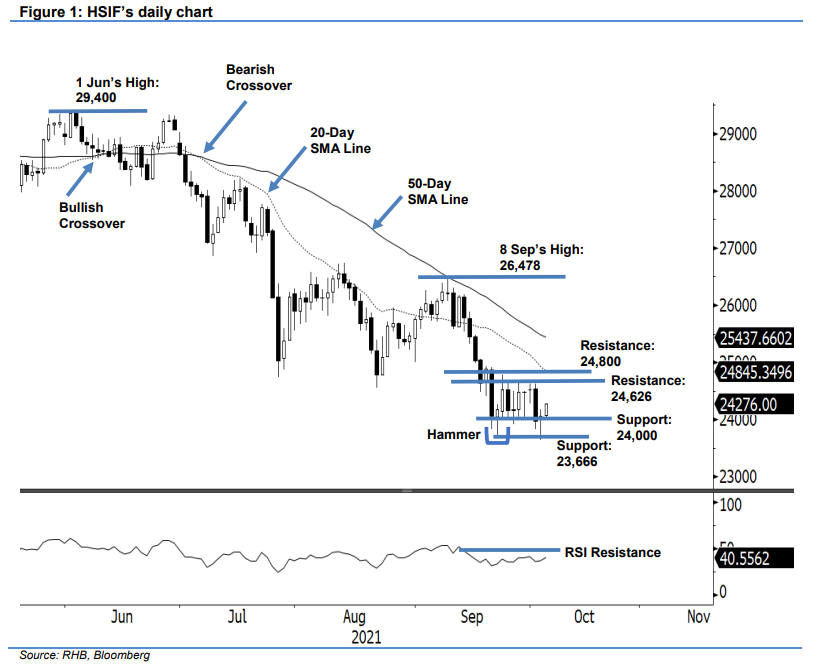

Maintain short positions. The HSIF saw the negative momentum failing to follow through yesterday, rebounding 84 pts to settle the day session at 24,058 pts – forming a Hammer candlestick near the support. On Tuesday morning, the index initially started at 23,861 pts. Cautious sentiment saw it fall to the 23,643-pt day low. Strong buying interest emerged near the intraday low, lifting the HSIF to pare its intraday losses and progress higher to touch the 24,177-pt day high before the session ended. During the evening session, it jumped 218 pts and last traded at 24,276 pts. The latest session showed the bears were taking a breather, which may see the index reverting to a sideways movement again. However, the RSI is still hovering below the 50% threshold, indicating the upside momentum is limited at this juncture. While the HSIF is consolidating, the risk of a “higher high” forming is slim. Hence we keep to our bearish trading bias.

Traders are advised to hold on to the short positions initiated at 25,646 pts, ie the close of 9 Sep’s day session. For trading-risk management, the trailing-stop threshold is placed at 24,800 pts.

The immediate support is revised to the 24,000-pt round figure, followed by 23,666 pts, ie 21 Sep’s low. The nearest resistance is stuck to 24,626 pts – 4 Oct’s high – and followed by the 24,800-pt whole number.

Source: RHB Securities Research - 6 Oct 2021