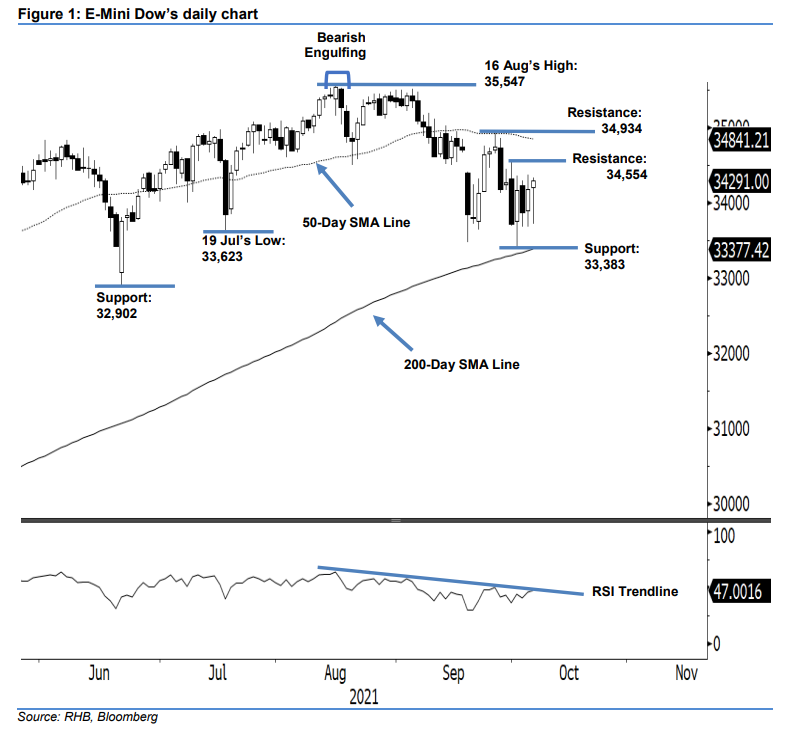

E-Mini Dow: Remaining in Sideways Movement Below the 34,554-Pt Resistance

rhboskres

Publish date: Thu, 07 Oct 2021, 08:28 AM

Maintain short positions. The E-Mini Dow had a volatile session yesterday, paring all its intraday losses to close 108 pts higher at 34,291 pts – still below the 34,554-pt immediate resistance. It started on a positive note at 34,208 pts, and gradually fell until the early part of the US trading session, when it touched the 33,718-pt intraday low. Strong buying pressure emerged from the bottom, propelling the index upwards for the rest of the session. It hit the day’s peak at 34,326 pts prior to the close. The latest white body candlestick with long lower shadow suggests that the bears are still struggling to move the index lower, towards the 33,383-pt immediate support. At this juncture, we expect the index to whipsaw between the 34,554-pt immediate resistance and 33,383-pt immediate support in the next session, while the medium term bearish outlook remains intact – maintaining the “lower high” pattern below the 50-day average line. With the RSI still hovering below the 50% level, we do not expect a strong uptrend reversal in the medium term. We stick to our bearish trading bias until the stop-loss is triggered.

We suggest traders stay with the short positions initiated at 34,175 pts, or 29 Sep’s close. To mitigate risks, the initial stop-loss is placed at the 34,554-pt resistance, or the nearest resistance level.

The nearest support level is unchanged at 33,383 pts – 1 Oct’s low – followed by 32,902 pts or 21 Jun’s low. The resistance levels are fixed at 34,554 pts – 30 Sep’s high – and 34,934 pts, which was 27 Sep’s high.

Source: RHB Securities Research - 7 Oct 2021