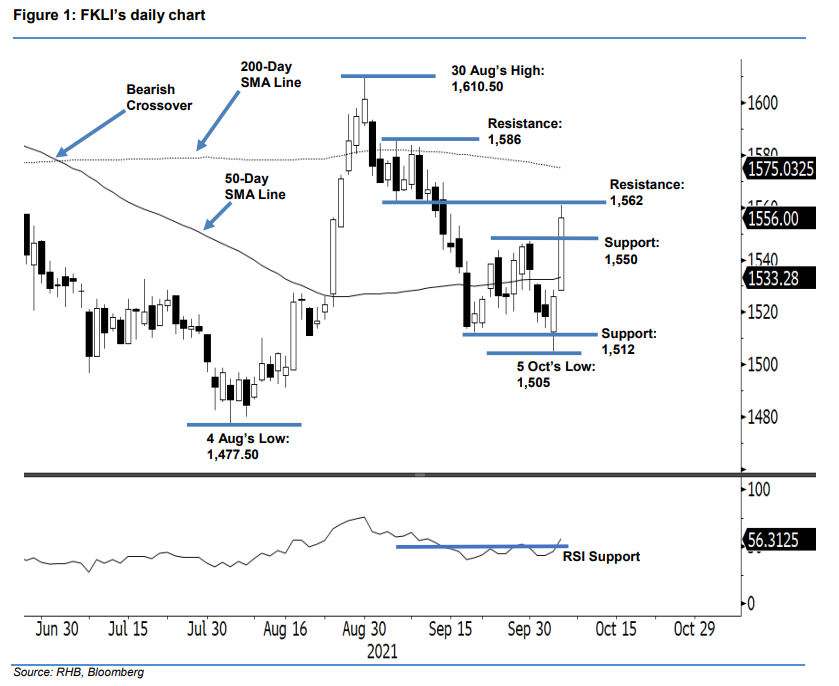

FKLI: Bouncing Off Strongly Above The 50-Day SMA Line

rhboskres

Publish date: Thu, 07 Oct 2021, 08:31 AM

Stop loss triggered; initiate long positions. The FKLI continued its earlier rebound by jumping higher yesterday, rising 30 pts to close at 1,556 pts – bouncing off above the 200-day average line. The index opened on a stronger note at 1,528.5 pts and persisted with its bullish momentum towards the end of the session, which saw it hit the day’s peak at 1,561 pts before retracing to close. The latest long white candlestick breaching the 1,550-pt immediate resistance yesterday signals that the bulls are back in the driver’s seat, as the FKLI formed a “higher high” bullish structure. Coupled with the RSI reclaiming above the 50% level, this renewed positive momentum may continue towards the 200- day SMA line in the coming sessions. Since the stop loss is triggered, we shift to a positive trading bias.

We closed out the short positions initiated at 1,520 pts – 1 Oct’s closing level – after the 1,535-pt stop-loss was triggered. Conversely, we initiate long positions at the closing level of 6 Oct, or 1,556 pts. To manage trading risks, the initial stop-loss threshold is placed at 1,520 pts.

The immediate support is set at 1,550 pts, followed by 1,512 pts, ie 21 Sep’s low. Conversely, the immediate resistance is introduced at 1,562 pts – 6 Sep’s low – and followed by the higher 1,586-pt resistance, or 6 Sep’s high.

Source: RHB Securities Research - 7 Oct 2021

.png)