COMEX Gold: Range-Bound Pending a Breakout

rhboskres

Publish date: Fri, 08 Oct 2021, 07:25 PM

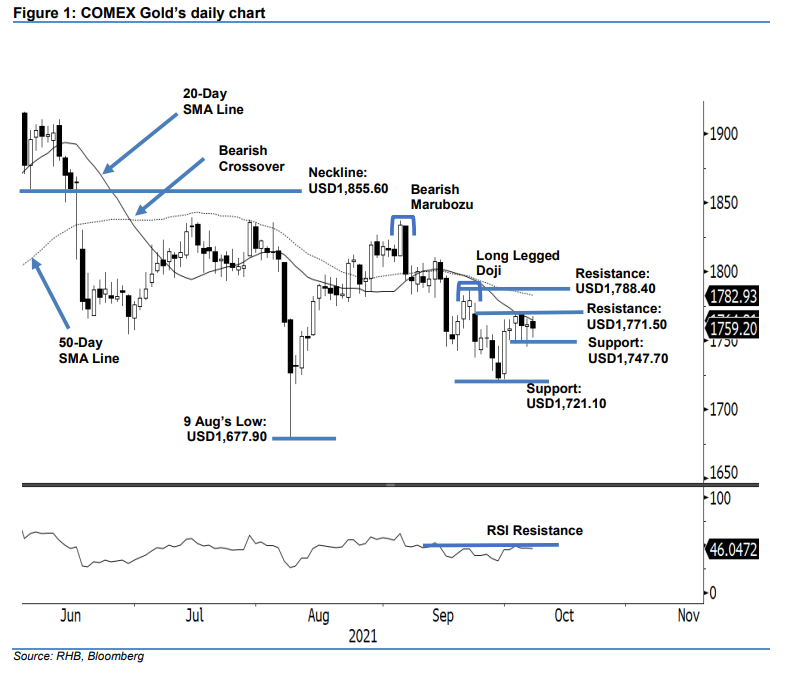

Maintain long positions. The COMEX Gold continued to be bound by sideways movements yesterday, dipping USD2.60 to settle at USD1,759.20. The commodity initially opened at USD1,763.80. After oscillating between USD1,767.70 and USD1,752, it closed at USD1,759.20 – a level beneath the 20-day SMA line. As mentioned in our previous note, the COMEX Gold is stuck between the USD1,771.50 and USD1,747.70 range. We anticipate the volatility picking up during Friday’s session, whereby the commodity may see a breakout on either side of the boundary. Breaching above the 20-day SMA line will extend the counter-trend upside movement, while falling below the support indicates the return of bearish sentiment. At this stage, we hold on to a positive trading bias until the stop-loss mark is triggered.

Traders should stay in the long positions initiated at USD1,767.60, ie the closing level of 4 Oct. Conversely, to control the downside risks, the stop-loss threshold is fixed at USD1,743.

The immediate support remains at USD1,747.70 – 4 Oct’s low – and followed by USD1,721.10, or 29 Sep’s low. The first resistance is unchanged at USD1,771.50 – 4 Oct’s high – and followed by USD1,788.40, ie 22 Sep’s high.

Source: RHB Securities Research - 8 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024