E-Mini Dow: the Bullish Momentum Extends

rhboskres

Publish date: Fri, 08 Oct 2021, 07:25 PM

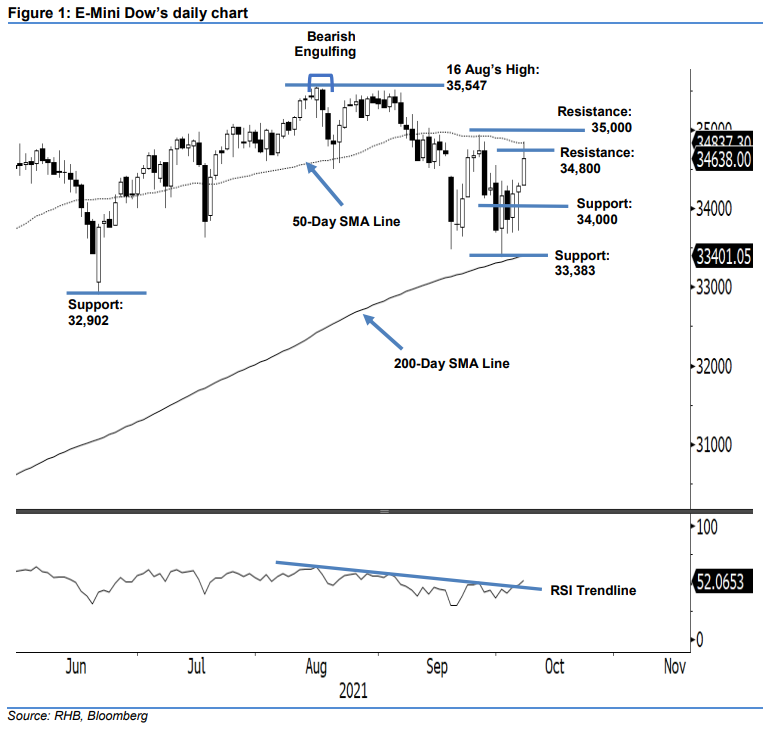

Stop loss triggered; initiate long positions. The E-Mini Dow saw the bullish momentum extend yesterday, jumping 347 pts to settle at 34,638 pts. Following a candlestick with long lower shadow that formed on Wednesday, the index started the session on a stronger note, opening at 34,300 pts and surging towards the 34,854-pt intraday high. After touching the 50-day SMA line, it retraced midlly to close at 34,638 pts – forming a fresh “higher high”. The latest bullish candlestick indicates that sentiment remains risk-on as of yesterday, whereby the RSI crossed above the trend line. If the E-Mini Dow manages to stay above the 34,000-pt psychological level and forms a candlestick with “higher high”, the bulls may attempt to cross the 34,800-pt resistance and retest the overhead resistance of the 50-day SMA line. Since the stop-loss mark is breached, indicating that the bullish momentum picking up pace again, we revert to a positive trading bias.

We closed out the short positions initiated at 34,175 pts – 29 Sep’s close – after the stop loss at 34,554 pts was triggered. Conversely, we initiate long positions at the closing level of 7 Oct, ie 34,638 pts. To manage the trading risks, the initial stop-loss threshold is set at the 34,000-pt level.

The nearest support mark is revised to the 34,000-pt round figure and followed by 33,383 pts, 1 Oct’s low. The immediate resistance is at the 34,800-pt round figure, followed by the 35,000-pt psychological level.

Source: RHB Securities Research - 8 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024