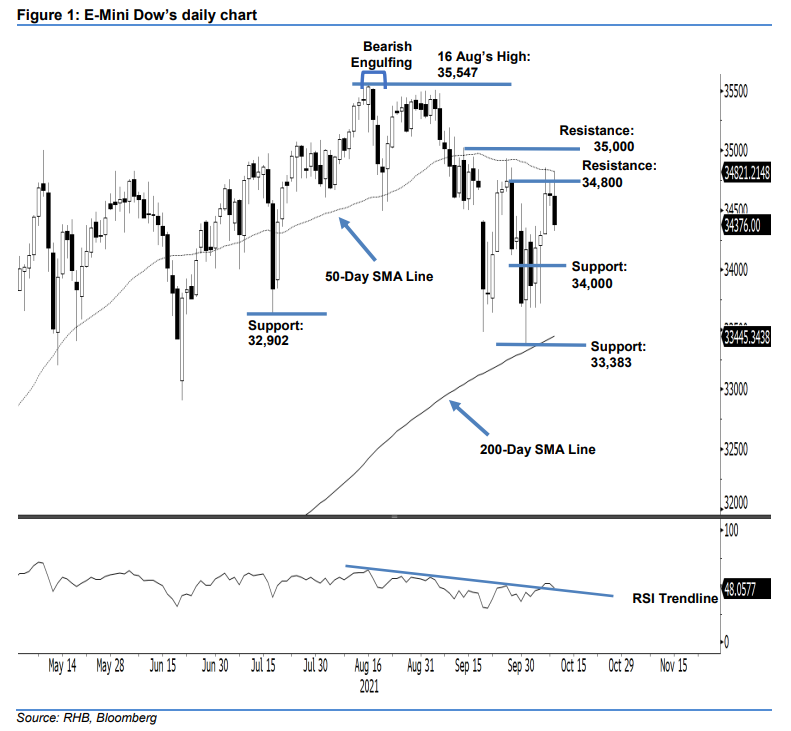

E-Mini Dow: Falling Further Away Below the 50-Day SMA Line

rhboskres

Publish date: Tue, 12 Oct 2021, 08:29 AM

Maintain long positions. Despite attempting to move higher yesterday, the E-Mini Dow pared all its intraday gains and closed with a strong negative momentum – setting 250 pts lower at 34,376 pts. The index began at 34,614 pts and experienced volatility throughout the session, which saw it reach the day’s top at 34,829 pts before reversing strongly southwards during the mid-US trading session. It hit the day’s low at 34,323 pts before the close. The latest bearish candlestick with long upper shadow suggests that sentiment has turned bearish below the 50-day average line, which may now continue towards the 34,000-pt immediate support. Coupled with the RSI strength declining below the 50% level, the profit-taking activities are expected to continue further until strength is renewed. However, the longer-term direction remains bullish as the E-Mini Dow stays above the 200-day average line. Since the stop-loss level has yet to be breached, we keep to our positive trading bias.

We suggest traders stick to the long positions we initiated at the closing level of 7 Oct, ie 34,638 pts. To manage the trading risks, the initial stop-loss threshold is set at the 34,000-pt level. T

he nearest support level is unchanged at the 34,000-pt round figure and is followed by 33,383 pts, ie 1 Oct’s low. The immediate resistance is at the 34,800-pt round figure, followed by the 35,000-pt psychological level.

Source: RHB Securities Research - 12 Oct 2021