Hang Seng Index Futures: Struggling to Stay Above 25,000-Pts

rhboskres

Publish date: Tue, 12 Oct 2021, 08:30 AM

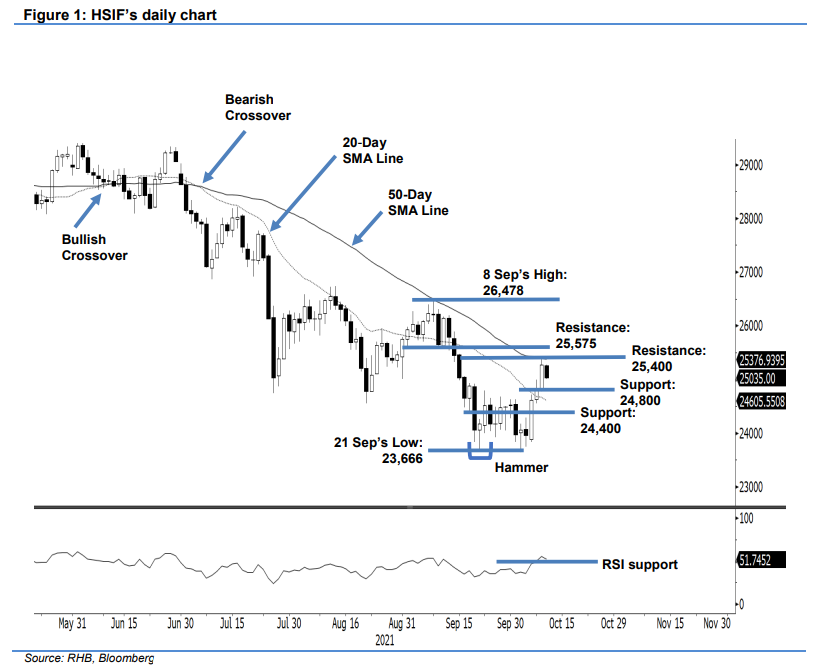

Maintain long positions. The HSIF extended its upward movement yesterday, rising 445 pts to settle the day session at 25,269 pts – breaching above 25,000 pts. The index started the first trading session of the week on a positive note, gapping up to open at 24,960 pts. Bullish momentum then lifted it towards the 25,382-pt day high before moving sideways until the close. During the evening session, the index saw strong profit-taking – tracking the weakness of its US peers – and retreated 234 pts. It was last traded at 25,035 pts. The HSIF managed to retain the 25,000-pt level despite strong negative momentum during the evening session. If negative momentum follows through, it may retrace lower to retest the 24,800-pt support level. A breach this level will see the RSI falling below the 50% threshold, indicating that the index is reverting to consolidation mode. As long as the index remains above the 20-day SMA line, we will keep our positive trading bias.

Traders should stick with the long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. To manage downside risks, the stop-loss is raised to 24,558 pts.

The immediate support is marked at 24,800 pts, followed by the 24,400-pt round figure. On the upside, the nearest resistance is pegged at the 25,400-pt round figure, followed by 25,575 pts or the low of 1 Sep.

Source: RHB Securities Research - 12 Oct 2021