Hang Seng Index Futures: Dipping Below the 25,000-Pt Level

rhboskres

Publish date: Wed, 13 Oct 2021, 04:55 PM

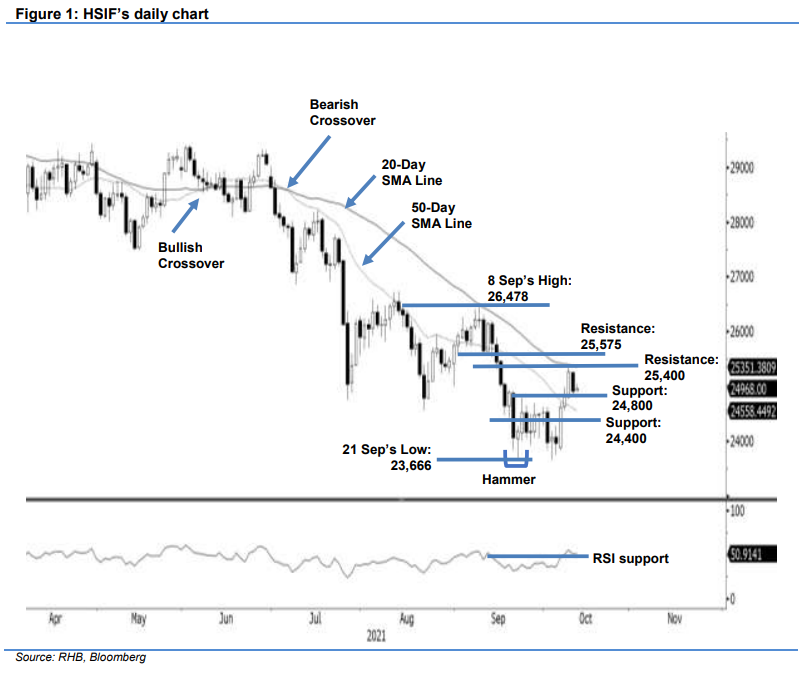

Maintain long positions. The HSIF showed early signs of weakness on profit taking activity, retreating 359 pts to settle the day’s session at 24,910 pts – falling below the 25,000-pt level. It gapped down and started Tuesday’s session at 24,897 pts. After the weak opening, it rebounded to test the day’s high of 25,139 pts before turning down again to touch the day’s low of 24,818 pts, closing weaker at 24,910 pts. The evening session saw the index recoup 58 pts to last trade at 24,968 pts. The session was called off early due to a typhoon warning issued by the authorities. Based on the latest price action, the index attempting to establish an interim low, after it broke past the 25,000-pt level on Monday’s session. A strong rebound in the subsequent session will deem the breakout to be successful. However, breaching the 24,800 pt immediate support would see the index falling back into a consolidation zone, and the bullish movement may end prematurely. We keep to our positive trading bias until the stop-loss is triggered.

We recommend traders to retain their long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. To manage the trading risks, the stop-loss is set at 24,558 pts.

The immediate support remains at 24,800 pts, followed by the 24,400-pt round figure. On the upside, the nearest resistance maintained at 25,400 pts, followed by 25,575 pts, or the low of 1 Sep.

Source: RHB Securities Research - 13 Oct 2021