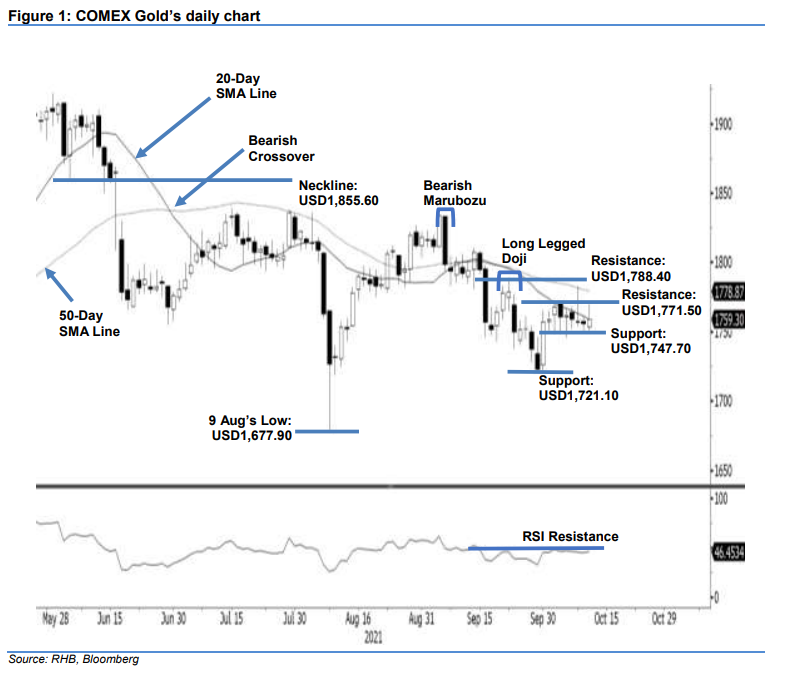

COMEX Gold: Attempting to Cross Above the 20-Day SMA Line

rhboskres

Publish date: Wed, 13 Oct 2021, 04:56 PM

Maintain long positions. The COMEX Gold attempted to cross the 20-day SMA line, rising USD3.60 to settle at USD1,759.30. Yesterday, it opened lower at USD1,753.60. Despite the weak opening, the commodity formed an intraday low of USD1,750.50, then reversed upwards during the US trading session to test the day’s high of USD1,770. The commodity then pared most of its intraday gains, as it retreated to close at USD1,759.30. The long upper shadow indicates selling pressure is persisting near the 20-day SMA line. As the moving average line is trending lower, the risk of a downtrend has increased. Meanwhile, the RSI is testing the 50% threshold, suggesting that the immediate term momentum favours an upside breakout. In the event the nearest support of USD1,747.70 gives way, expect selling pressure to intensify. Conversely, crossing the 20-day SMA line firmly will attract a follow through buying pressure. We maintain a positive trading bias until the stop-loss is triggered.

Traders should keep to their long positions initiated at USD1,767.60, or the closing level of 4 Oct. For management on trading risks, the stop-loss is marked at USD1,747.70 – the immediate support.

The immediate support remains at USD1,747.70 – 4 Oct’s low – followed by USD1,721.10, or 29 Sep’s low. The nearest resistance is kept at USD1,771.50 – 4 Oct’s high – followed by USD1,788.40, or 22 Sep’s high.

Source: RHB Securities Research - 13 Oct 2021