Hang Seng Index Futures : Counter-Trend Rebound Still in Play

rhboskres

Publish date: Fri, 15 Oct 2021, 04:51 PM

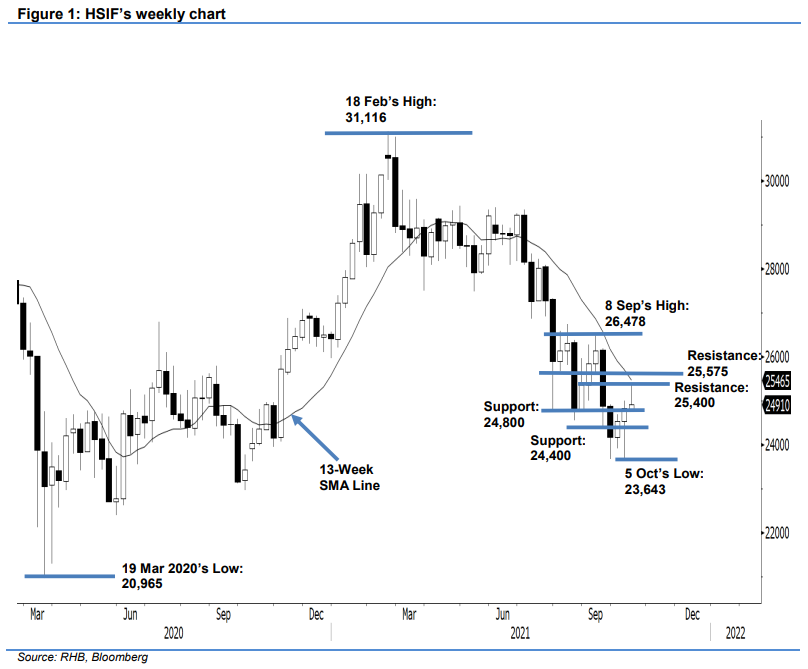

Maintain long positions. The HSIF found its interim base at October’s low and rebounded sharply to settle Tuesday’s session at 24,910 pts. After trading at 24,968 pts in the evening, the following session was cancelled due to disruption caused by the typhoon. For the medium term, the index still bound by the downtrending of the 13-week SMA line. As long as it trades below the moving average, the bears will have a technical advantage. On a smaller time frame, the index has been making a counter-trend rebound since breaking past the 24,800-pt threshold, with the momentum still in play despite mild profit taking activities witnessed lately. In the event the HSIF drops below the 24,800-pt level, this will be regarded as a false breakout. Otherwise, the index may resume its upward movement once profit taking ends. At this juncture, we maintain our positive trading bias until the stop-loss is triggered.

Traders are recommended to retain their long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. To mitigate the trading risks, the stop-loss is fixed at 24,558 pts.

For the near term, the immediate support stays at 24,800 pts, followed by the 24,400-pt round figure. Towards the upside, the nearest resistance is sighted at 25,400 pts, followed by 25,575 pts, or the low of 1 Sep.

Source: RHB Securities Research - 15 Oct 2021