COMEX Gold: Strong Profit-Taking; Retesting the 20-Day SMA Line

rhboskres

Publish date: Mon, 18 Oct 2021, 08:49 AM

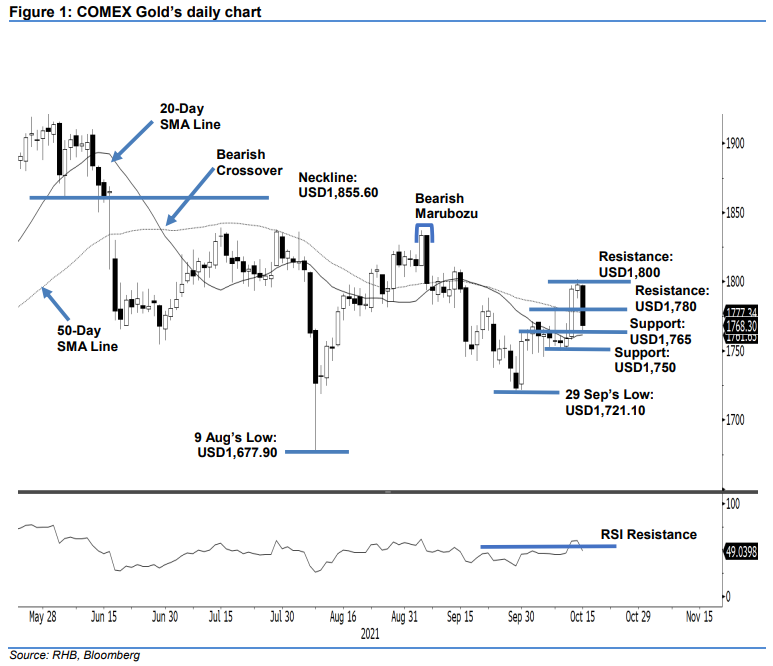

Trailing stop triggered; initiate short positions. The COMEX Gold experienced strong profit-taking on Friday, retracing USD29.60 to settle at USD1,768.30. Initially, the commodity opened slightly weaker at USD1,797.30, and the bulls soon shied away, sending the index downwards – breaching its previous support level of USD1,788.40. It reached the session’s low of USD1,765.10 before closing weaker at USD1,768.30. The latest session also saw the commodity falling below the 50-day SMA line, indicating that the medium-term trend remains bearish. If the COMEX Gold is able to stay above the 20-day SMA line, it may consolidate sideways. Otherwise, a breach of the USD1,750 support level could lead it lower to retest September’s low of USD1,721.10. As the trailing stop was breached, we shift over to a negative trading bias.

We closed out the long positions initiated at USD1,767.60, or the closing level of 4 Oct, after the trailing-stop at USD1,775 was triggered. Conversely, we initiate short positions at the closing level of 15 Oct, or USD1,768.30. To manage trading risks, the initial stop loss is placed at USD1,780.

The immediate support is revised to USD1,765 – 30 Sep’s high – followed by the USD1,750 psychological level. Meanwhile, the first resistance is pegged at USD1,780, followed by the USD1,800 round number.

Source: RHB Securities Research - 18 Oct 2021