E-Mini Dow: Breaching Above the 50-Day SMA Line

rhboskres

Publish date: Mon, 18 Oct 2021, 08:50 AM

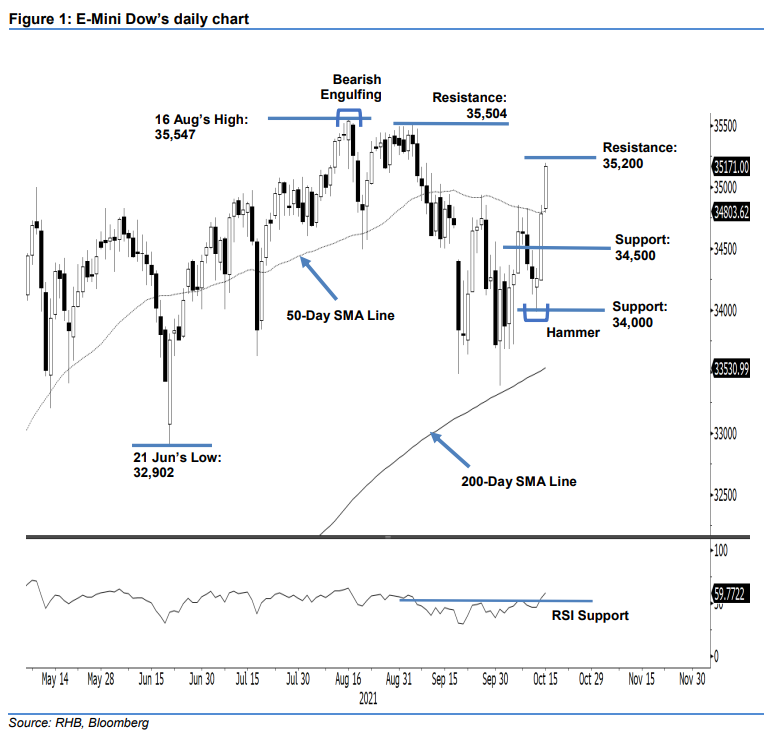

Maintain long positions. The E-Mini Dow extended its bullish momentum last Friday, and surpassed the overhead resistance of the 50-day SMA line. It rose 387 pts to settle at 35,171 pts. The index opened at 34,830 pts, and soon found its intraday low at 34,787 pts. It then reversed to move upwards, progressing higher throughout the session. It touched the intraday high of 35,198 pts before closing stronger at 35,171 pts. As we had anticipated, crossing the 50-day SMA line has improved market sentiment. The bulls are now firmly in control, and establishing a foothold above the moving average line will strengthen the bullish technical setup. While the bulls are looking to test the upside resistance, we do not rule out profit-taking in coming sessions. If this happens, the index may retrace to retest its downside support at the 50-day SMA line. For now, we believe the rally has more legs, and make no change to our positive trading bias.

We recommend traders retain the long positions initiated at the closing level of 7 Oct, or 34,638 pts. To manage trading risks, the stop-loss threshold is raised to 34,500 pts.

The nearest support level is marked at 34,500 pts followed by 34,000-pt round number. On the upside, the immediate resistance is eyed at 35,200 pts, followed by 35,504 pts, or the high of 3 Sep.

Source: RHB Securities Research - 18 Oct 2021