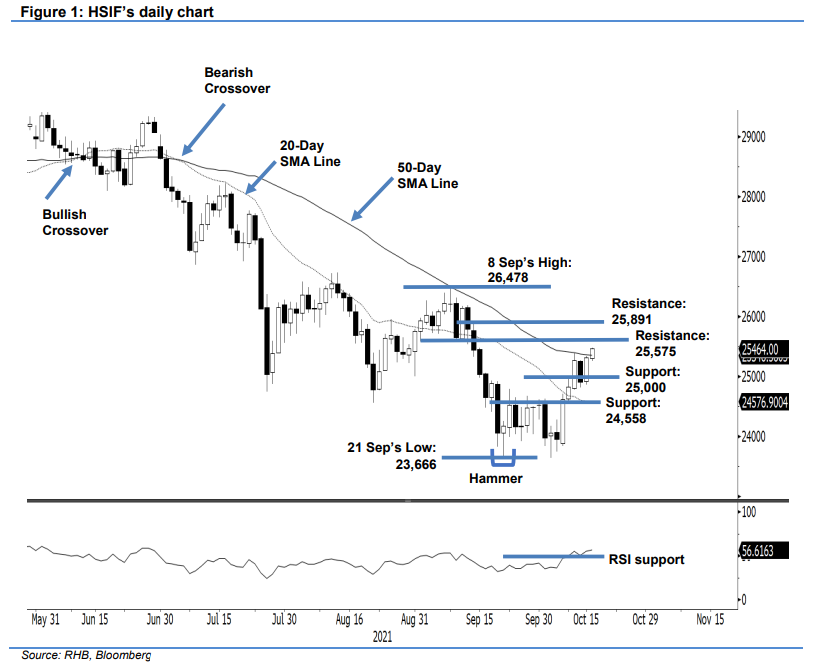

Hang Seng Index Futures: Bouncing Strongly Off the 25,000-Pt Level

rhboskres

Publish date: Mon, 18 Oct 2021, 08:52 AM

Maintain long positions. After disruptions due to the typhoon and Double Ninth Festival holiday, the HSIF resumed trading on Friday with strong buying interest – soaring 408 pts to settle the day session at 25,318 pts. It opened at 25,143 pts with cautious sentiment, and then fell to the 24,860-pt day low. After finding its footing at the day’s low, the index reversed upwards with strong momentum, paring its intraday losses and reaching the 25,337-pt day high before the close. It advanced further during the evening session, adding 146 pts, and was last traded at 25,464 pts. The latest price action saw the index cross above the 50-day SMA line with positive momentum. The session also reaffirmed the strong support at the 25,000-pt psychological level. As long as the index continues to print a “higher low” bullish pattern, it may rise to test the 25,575-pt resistance level. So far, the counter-trend movement is strengthening its bullish setup. We retain our positive trading bias until the bearish reversal signal emerges.

Traders should stick to the long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. To manage trading risks, the stop-loss is raised to 24,775 pts.

The immediate support is sighted at the 25,000-pt round figure, followed by 24,558 pts, or the low of 8 Oct. Conversely, the first resistance is eyed at 25,575 pts (1 Sep’s low), followed by 25,891 pts (the high of 14 Sep).

Source: RHB Securities Research - 18 Oct 2021