COMEX Gold: Seeking Support Near the 20-Day SMA Line

rhboskres

Publish date: Wed, 20 Oct 2021, 04:39 PM

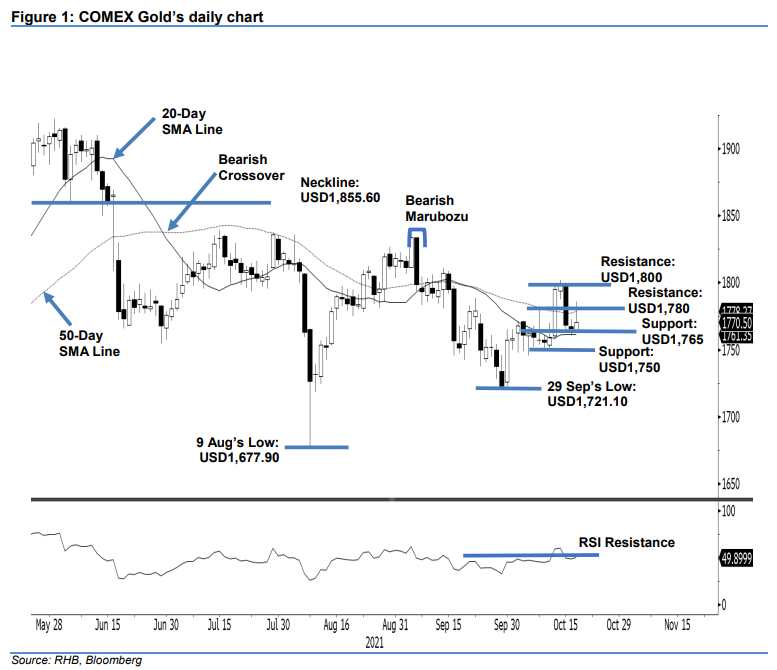

Maintain short positions. The COMEX Gold saw selling pressure taper yesterday, as it attempted to find a footing near the 20-day SMA line. It rebounded USD4.80 to settle at USD1,770.50. The commodity opened at USD1,764.80 on Tuesday, and touched the day’s low of USD1,763.40. Buying pressure emerged near the 20-day SMA line, sending the index upwards to test the day’s high of USD1,786 before closing at USD1,770.50. As mentioned in our previous note, as long as the index stays above the 20-day SMA line, it will likely consolidate sideways. We observe that the RSI is still capped below the 50% threshold, indicating that momentum is not ready to break past the overhead resistance of the 50-day SMA line – more consolidation is needed. If momentum falters, the commodity may drop below the 20-day SMA line, and see further downside risk. At this juncture, we maintain our negative trading bias until the 50-day SMA line is breached.

We recommend traders maintain the short positions initiated at USD1,768.30 or the closing level of 15 Oct. To manage trading risks, the initial stop loss is set at USD1,780 – a level above the 50-day SMA line.

The immediate support is marked at USD1,765 – 30 Sep’s high – followed by the USD1,750 psychological level. On the upside, the first resistance is pegged at USD1,780, followed by the USD1,800 round number.

Source: RHB Securities Research - 20 Oct 2021