WTI Crude: Printing Higher at a Fresh 52-Week High

rhboskres

Publish date: Wed, 20 Oct 2021, 04:40 PM

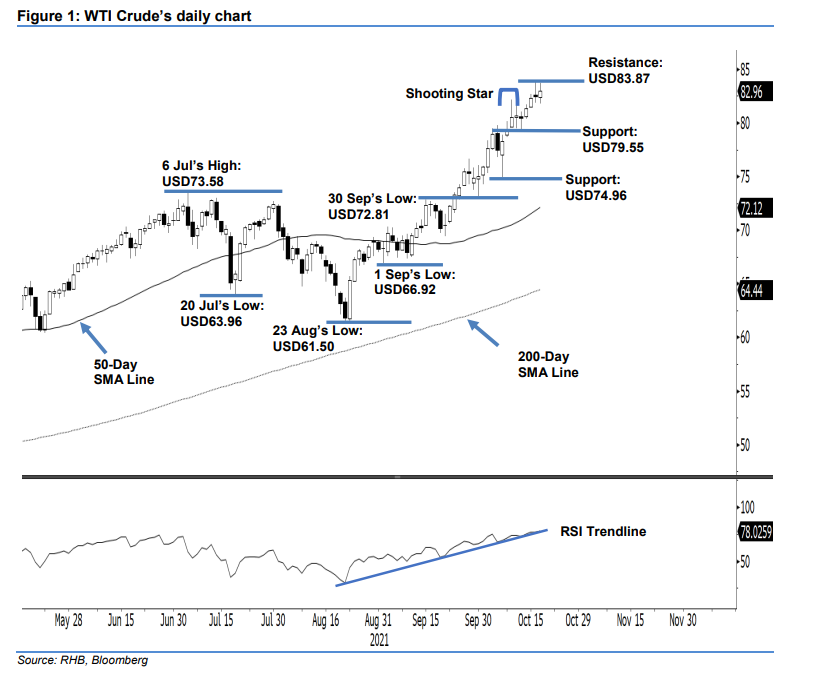

Maintain long positions. The WTI Crude edged higher yesterday – closing USD0.52 greater at USD82.96 – as it attempted to move above Monday’s high. The commodity began the session at USD82.37. It then moved in a sideways direction before whipsawing to hit its day low of USD81.80 and the USD83.74 day high – it then retraced to settle at USD82.96. The last two sessions showed the bulls were struggling to move above the USD83.87 immediate resistance, supported by long upper shadow candlesticks. We expect profit-taking to take place in the immediate sessions. Though the RSI was still pointing higher yesterday, the strength index has almost reached the 80% overbought territory level. The positive momentum will only be renewed if the WTI Crude manages to breach the immediate resistance mark. Since the medium-term outlook remains bullish above the USD79.55 immediate support level, we keep to our positive trading bias.

Traders should stick to the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage the trading risks, the trailing-stop threshold is placed at USD79.55, ie the immediate support level.

The support levels remain at USD79.55 – 11 Oct’s low – and USD74.96, which was 7 Oct’s low. The resistance threshold is set at the USD83.87, or 18 Oct’s high. This is followed by the higher resistance at USD90.00.

Source: RHB Securities Research - 20 Oct 2021