Hang Seng Index Futures: Bullish Momentum Picking Up Above 25,000 Pts

rhboskres

Publish date: Wed, 20 Oct 2021, 04:41 PM

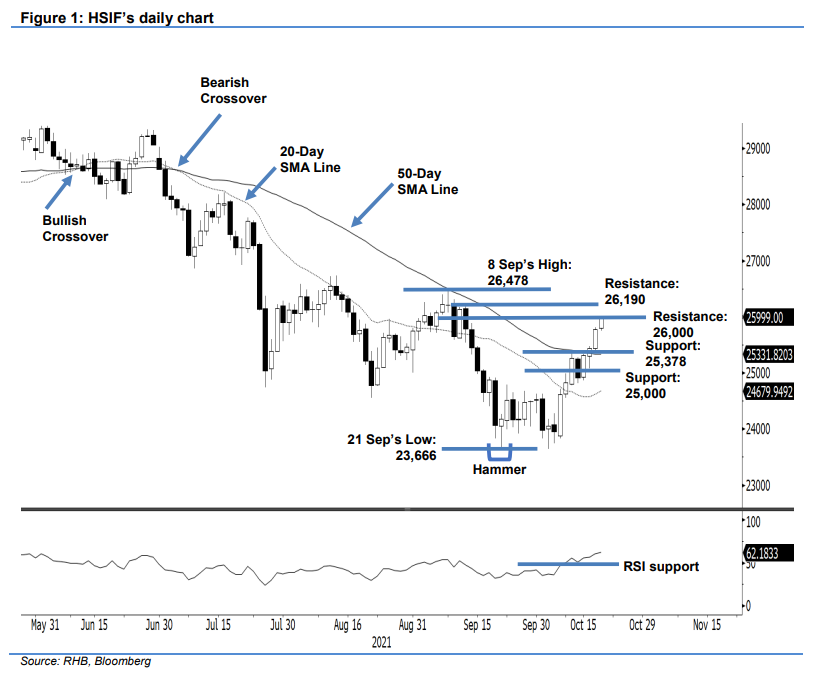

Maintain long positions. After climbing above 25,000 pts, the HSIF saw bullish momentum garner positive strength – soaring 339 pts to settle the day session at 25,775 pts. It opened at 25,500 pts on Tuesday. Not long after the session opened, strong buying momentum lifted it towards the 25,808-pt day high. The index moved sideways until the end of the session. In the evening session, it tracked its US peers’ bullish sentiment, jumping 224 pts, and was last traded at 25,999 pts. The latest session showed that the recent counter-trend rebound still has legs on the upside. As long as the index continues to trade above the 20-day and 50-day SMA lines, sentiment will remain positive. This, coupled with the RSI pointing upwards, suggests that immediate term momentum may break past the 26,000-pt psychological level. As the bulls are still in control, we stay with our positive trading bias.

We recommend traders hold on to the long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. To manage trading risks, the stop-loss is raised to 25,000 pts.

The nearest support is set at 25,378 pts, which was the low of 19 Oct, followed by the 25,000-pt round figure. On the upside, the immediate resistance is eyed at the 26,000-pt psychological level, followed by 26,190 pts, or 13 Sep’s high.

Source: RHB Securities Research - 20 Oct 2021