Hang Seng Index Futures: Breaking Past the 26,000-Pt Level

rhboskres

Publish date: Thu, 21 Oct 2021, 04:48 PM

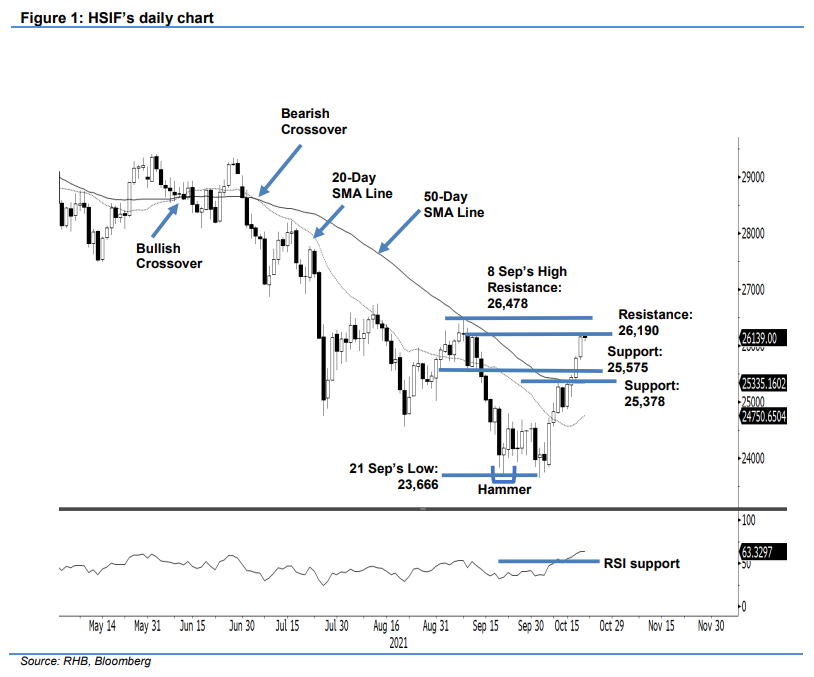

Maintain long positions. The HSIF advanced 381 pts yesterday to settle the day session at 26,156 pts – on its way towards marking a 5-week high. It opened stronger at 25,955 pts. During the early morning session, it dipped to 25,858 pts on mild profit-taking activities. After reaching the intraday low, the index rebounded higher – breaching the crucial 26,000-pt level to close stronger at 26,156 pts. It then retreated 17 pts during the evening session and last traded at 26,139 pts. The latest session showed the HSIF had convincingly crossed the 26,000-pt mark and that the bullish momentum has not shown any signs of weakening yet. In the event the bears decide to take profit, we expect strong support to be found near the 50-day SMA line. With the bullish rebound movement still in play, the bulls may look to challenge the 26,190-pt immediate resistance, followed by September’s high of 26,478 pts. As of now, we stick with our positive trading bias.

Traders should keep the long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. To manage the downside risks, the trailing-stop threshold is fixed at 25,200 pts.

The nearest support is marked at 25,575 pts – 1 Sep’s low – and followed by 25,378 pts, which was 19 Oct’s low. The immediate resistance is pegged at 26,190 pts – 13 Sep’s high – and followed by 26,478 pts, ie 8 Sep’s high.

Source: RHB Securities Research - 21 Oct 2021