FKLI: Bullish Momentum Still In Place

rhboskres

Publish date: Thu, 21 Oct 2021, 04:53 PM

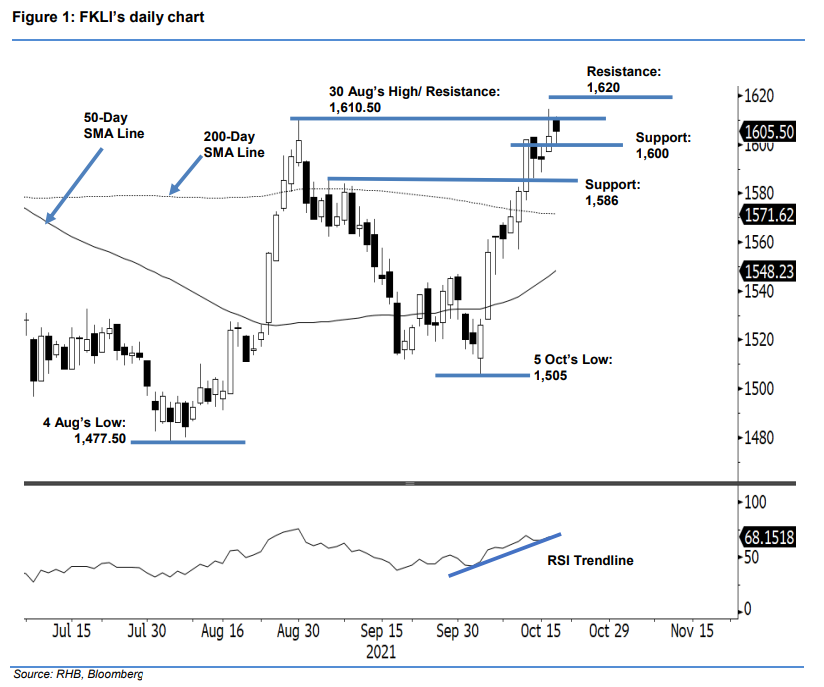

Maintain long positions. Despite mild profit-taking during the early session, the FKLI maintained a bullish posture and gained 2.00 pts to close at 1,605.50 pts. Initially, the index resumed trading with a positive sentiment, gapping up to open at 1,610 pts. Selling pressure persisted near the immediate resistance, and pulled the index to graze the day’s low of 1,600 pts. Bargain-hunting emerged near the intraday low, whereupon the FKLI rebounded in the second half of the session to a close. This latest session shows that the index still printing a fresh “higher low” candlestick, indicating buying pressure is greater than the selling pressure. As long as the index stays above the 1,600-pt psychological level, it may rise higher to retest August’s high of 1,610.50 pts. Breaching the threshold may attract follow-through buying pressure. Since the bullish structure is still intact, we are maintaining a positive trading bias.

Traders should stick to long positions, initiated at 1,556 pts or the closing level of 6 Oct. To limit the downside risks, the trailing-stop is placed at 1,586 pts.

The immediate support is at the 1,600-pt psychological level, followed by 1,586 pts or the low of 14 Oct. Towards the upside, the nearest resistance remains at 1,610.50 pts – the high of 30 Aug – followed by the 1,620-pt round figure.

Source: RHB Securities Research - 21 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024