FCPO: Strong Profit-Taking Activities Emerge

rhboskres

Publish date: Fri, 22 Oct 2021, 05:36 PM

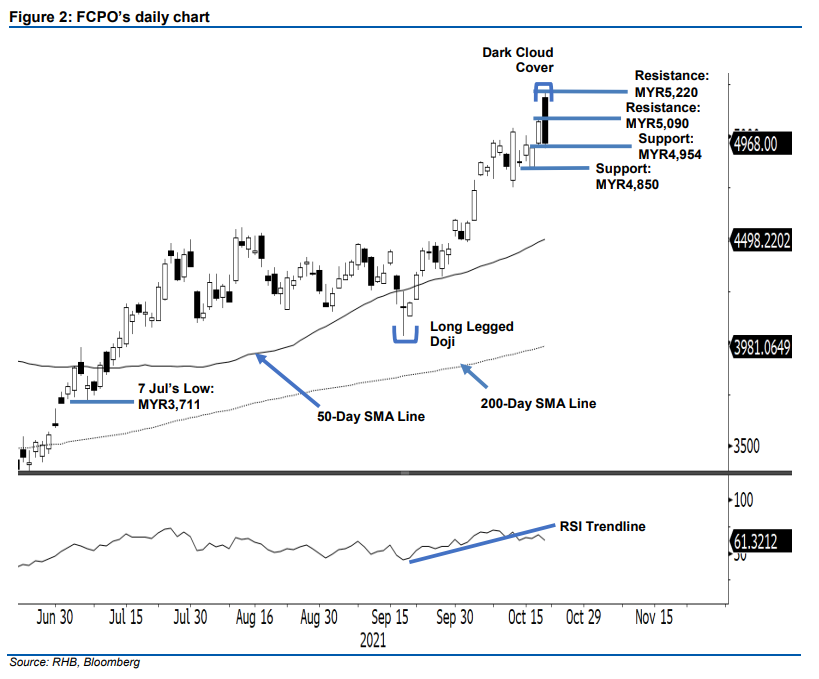

Maintain long positions. The FCPO saw strong profit-taking activities taking place yesterday after the commodity reached its all-time high, then retraced by MYR103.00 to close weaker at MYR4,968. Yesterday, the commodity initially gapped up to start the session at MYR5,190. It then rose further to MYR5,220, marking a fresh all-time high. Soon after the commodity recorded the historical mark, the bears took control. The FCPO reversed course, and hit the session’s low of MYR4,940, before closing at MYR4,968. The latest session showed the negative momentum is growing. If the commodity breaches the immediate support of MYR4,954, expect a follow-through negative price action to test the lower support of MYR4,850. To resume the upward movement, the FCPO needs to move past the MYR5,090 immediate resistance or at least reclaim the MYR5,000 psychological level. At this juncture, we will stick to a positive trading bias until the trailing-stop is breached.

Traders should retain the long positions initiated at the closing level of 22 Sep or MYR4,330. To protect the downside risks, the trailing-stop is placed at MYR4,954.

The immediate support has been revised to MYR4,954 or the low of 20 Oct, followed by MYR4,850 ie the low of 18 Oct. Conversely, the immediate resistance is pegged at MYR5,090, the high of 20 Oct, then the all-time high of MYR5,220.

Source: RHB Securities Research - 22 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024