Hang Seng Index Futures: Pullback From Recent High; Hovering Near 26,000 Pts

rhboskres

Publish date: Fri, 22 Oct 2021, 05:40 PM

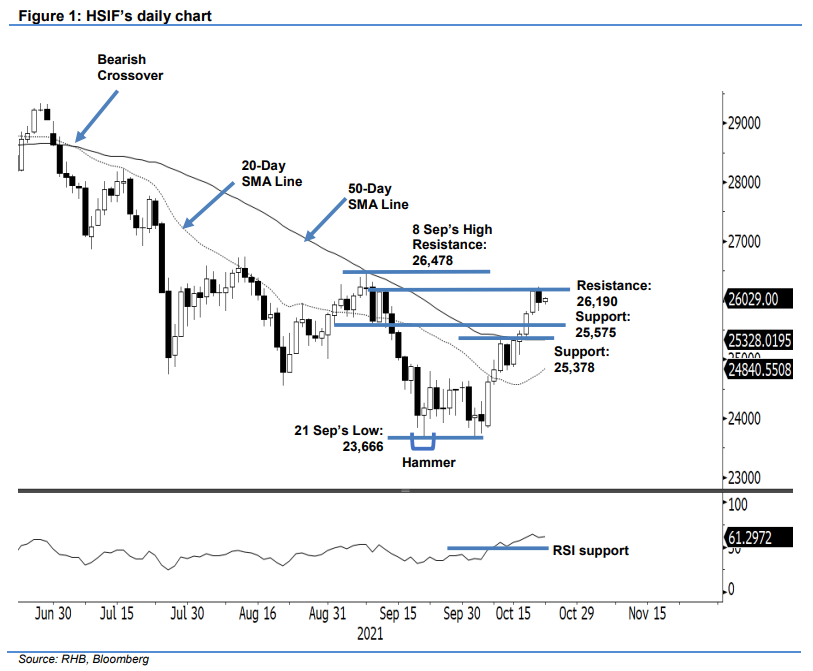

Maintain long positions. The HSIF saw a pullback from its recent high yesterday, consolidating near the 26,000-pt level. It opened weaker at 26,120 pts, and then rebounded to test the 26,224-pt day high. Positive momentum failed to follow through in the afternoon, with the bears taking control for the rest of session. The index fell to the 25,819-pt day low and closed at 25,970 pts. In the evening session, it recouped 59 pts and last traded at 26,029 pts. The session showed that the index is not ready to give up the 26,000-pt territory. However, selling pressure persists above the psychological threshold. The index may undergo further consolidation in the next session, before a fresh attempt to cross the 26,000-pt level, and test the 26,190-pt upside resistance. Although it is flashing early signs of bearish reversal, we see this as mild profit-taking, and keep our positive trading bias until the trailing-stop is breached.

Traders should retain the long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. For risk management, the trailing-stop threshold is adjusted to 25,250 pts.

The nearest support remains at 25,575 pts – 1 Sep’s low – followed by 25,378 pts, which was 19 Oct’s low. The immediate resistance is sighted at 26,190 pts – 13 Sep’s high – followed by 26,478 pts, or 8 Sep’s high.

Source: RHB Securities Research - 22 Oct 2021