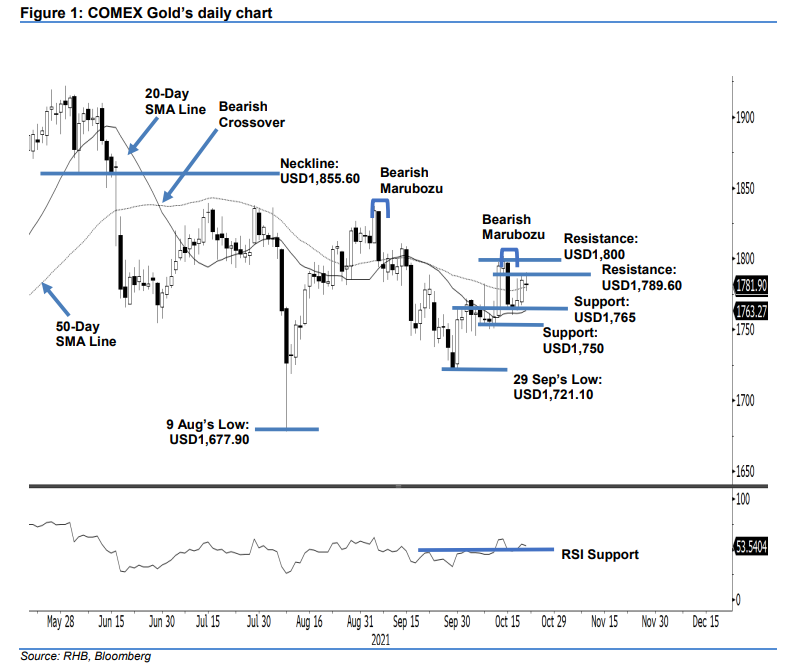

COMEX Gold: Consolidating Near the 50-Day SMA Line

rhboskres

Publish date: Fri, 22 Oct 2021, 05:41 PM

Maintain long positions. Despite a mild retracement, the COMEX Gold maintained its position above the 50-day SMA line – it fell USD3.00 to settle at USD1,781.90. The commodity opened at USD1,782.50 yesterday, and attempted to move higher, testing the day’s high of USD1,790.30. However, bullish momentum failed to follow through, and the commodity saw a pullback to the day’s low of USD1,776.80 before closing at USD1,781.90. As long as it stays above the 50-day SMA line, we think upside risks remain. The latest session also saw a fresh “higher low” bullish pattern, with the RSI trending above the 50% threshold. The technical indicators favour a bullish breakout. As such, we maintain our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,784.90 or the closing level of 20 Oct. To manage downside risks, the initial stop-loss is placed at the USD1,750 round figure.

The immediate support is marked at USD1,765 – 30 Sep’s high – followed by the USD1,750 psychological level. The nearest resistance is eyed at USD1,789.60 – 20 Oct’s high – followed by the USD1,800 round number.

Source: RHB Securities Research - 22 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024