COMEX Gold - Bullish Momentum Picking Up Pace

rhboskres

Publish date: Mon, 25 Oct 2021, 11:01 AM

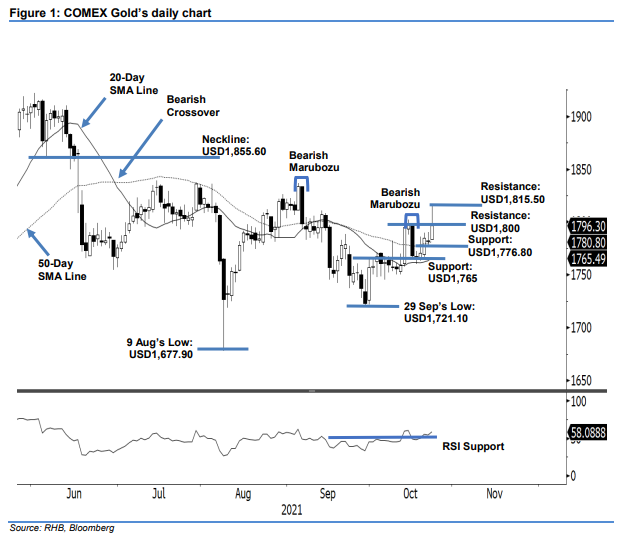

Maintain long positions. The COMEX Gold saw strong upward movement on Friday, surging USD14.40 to settle at USD1,796.30. The commodity opened at USD1,783.70, and progressed higher throughout the session. After breaking past the previous resistance level of USD1,789.60, momentum accelerated, sending the index to the USD1,815.50 session high. Strong profit-taking at the intraday high dragged it to the session’s low of USD1,783.40 before closing stronger at USD1,796.30. The session saw buying interest gain traction – forming a fresh “higher high” bullish pattern. The bulls are now eyeing the USD1,800 psychological level. A breach of this threshold will attract strong follow-through price action. As the commodity is firming its position above the 50-day SMA line, and is poised for an upside breakout, we hold on to our positive trading bias.

We advise traders to stick to the long positions initiated at USD1,784.90 or the closing level of 20 Oct. To mitigate downside risks, the stop-loss is adjusted higher to USD1,760.

The immediate support is revised to USD1,776.80 – 21 Oct’s low – followed by the USD1,765 round figure. On the upside, the nearest resistance is eyed at the USD1,800 psychological level, followed by USD1,815.50, or 22 Oct’s high.

Source: RHB Securities Research - 25 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024