WTI Crude - Profit-Taking From the Top

rhboskres

Publish date: Tue, 26 Oct 2021, 11:03 AM

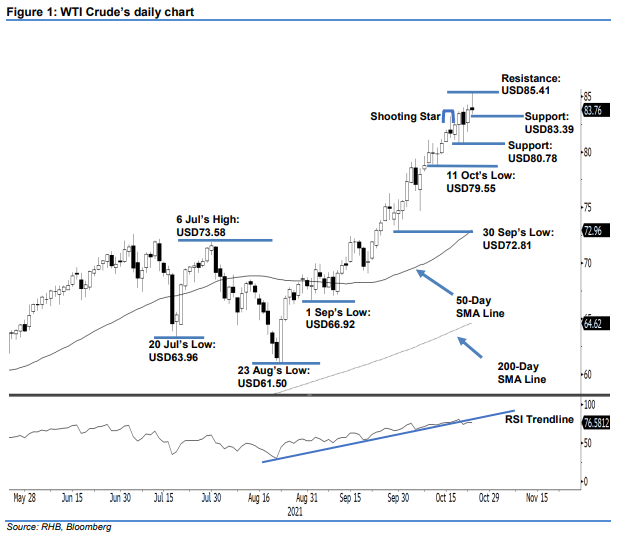

Keep long positions. After attempting to move higher, the WTI Crude took profit heavily from the intraday high, which saw it fall to Monday’s close of USD83.76 – below yesterday’s opening. The commodity started the session with a positive tone at USD83.98 before whipsawing in a positive direction. It then touched the day’s peak at USD85.41 during the early US trading session. Selling pressure then emerged to drag the WTI Crude significantly lower, which saw it hit the day’s bottom at USD83.39 before the close. The latest black body candlestick with long upper shadow – a shooting star candlestick formation – signifies the beginning of profit-taking activities from the recent peak. Furthermore, the leading RSI indicator has been displaying decreasing strength as of late. In line with our earlier expectation, strong profit-taking activities are expected to persist in the coming sessions. Since the trailing-stop has not been breached, we retain our bullish trading bias.

Traders should maintain the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage the trading risks, the trailing-stop threshold is revised to USD83.39.

The support levels are pegged at USD83.39 – 25 Oct’s low – and USD80.78, ie 20 Oct’s low. The resistance threshold is set at USD85.41, or 25 Oct’s high. This is followed by the USD90.00 round number.

Source: RHB Securities Research - 26 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024