FCPO - Blocked By MYR5,000 Resistance Mark

rhboskres

Publish date: Tue, 26 Oct 2021, 11:07 AM

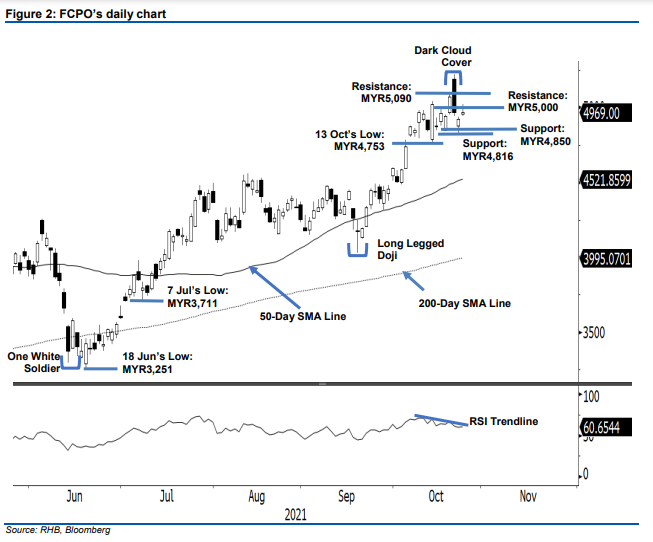

Maintain short positions. The FCPO extended its rebound on Monday’s session, rising MYR45 to settle at MYR4,969. Following Friday’s technical rebound, the commodity started Monday’s session stronger at MYR4,956. After touching the MYR4,944 day low, the commodity progressed higher towards MYR5,021 day high. However, selling pressure persists above the MYR5,000 mark. The resistance is stiff and capped the commodity’s upward movment - FCPO retreated to close at MYR4,969. Latest session saw the commodity formed a candlestick with long upper shadow – this affirm the MYR5,000 level has become a strong resistance. For immediate session, the commodity likely will consolidate sideways before a fresh attempt to cross above the MYR5,000 psychological level. Meanwhile, if the bulls fall back, it may drift lower to retest support at MYR4,850. As of now, we will retain our negative trading bias.

We recommend traders maintain the short positions initiated at MYR4,924 or the closing level of 22 Oct. To manage the trading risks, the initial stop-loss is fixed at MYR5,090.

The immediate support established at MYR4,850 – 18 Oct’s low – followed by MYR4,816 the low of 22 Oct. Towards the upside, the immediate resistance sighted at the MYR5,000 round figure and subsequent resistance at MYR5,090 or the high of 20 Oct.

Source: RHB Securities Research - 25 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024